By Richard Alexander

PRODUCTS offering 10% annual returns should be avoided like the plague, unless of course you are a sophisticated investor who really understands the type of investment you might be looking at.

I am not saying that there no investment option is capable of paying 10% annual income, in fact there are quite a few.

The problem comes when you start to look into the ‘guaranteed’ part of the deal when things start to get a little more complicated.

The advertisements that draw you in will be highlighting the headline rate of return and emphasising that there are guarantees; all very enticing but as always, the devil is in the small print!

The types of products that offer these returns could fall under the heading of unregulated collective investment schemes (UCIS) or could be properly regulated structured products.

The FSA in the UK has all but closed the door on UCIS schemes to UK advisers and as always with regulatory intervention, it wields the veritable sledgehammer to crack the tiny walnut and the collateral damage is that some otherwise quality investment options get closed down along the way. So much for the UCIS saga but what about structured products.

Once again, these can come in many forms and will broadly fall into categories where either the capital is at risk or the capital is protected/guaranteed. But it is what supports the guarantee that needs to be examined closely, because these types of investments are not funds in the traditional sense but are a collection of financial instruments or derivatives that are being packaged into a product that is designed to perform in a certain way, given that certain circumstances prevail.

In the event that the prescribed events do not happen, then there will be potential for reductions in the return if the capital is not protected, you probably will not see all of the capital returned at the end of the term.

Historically these structured products could be linked to a trackable index and can tolerate a certain amount of under-performance before the guarantees are breached. But even then you need to look carefully at who the counterparty to the arrangement is who is supplying the guarantee.

Often the product information will talk about the credit rating of the counterparty but even then you should think twice. After all, in July 2008,

Lehman Brothers was the fourth largest bank in the US with a strong credit rating and yet on 16 September that year, it filed for bankruptcy protection.

The fallout left thousands of investors with structured products that all of a sudden had no counterparty and while some were rescued, others were doomed to total failure.

The compensation and regulatory arguments go on today!

The moral of this story is very simple, if you are considering this type of investment, make sure that you understand the risk associated before committing any money. And even then don’t risk more than you are prepared to or perhaps can afford to lose.

Richard Alexander Financial Planning Limited is an appointed representative

of L J Financial Planning Limited, which is authorised and regulated

by the Financial Services Authority in the UK. Contact him at [email protected]

a simple S&P500 index fund is usually around 9-10% annually… Get one a bit heavier in tech and you climb towards 20% annually. Go figure. And some personal grooming sure would help with the credibility! lol

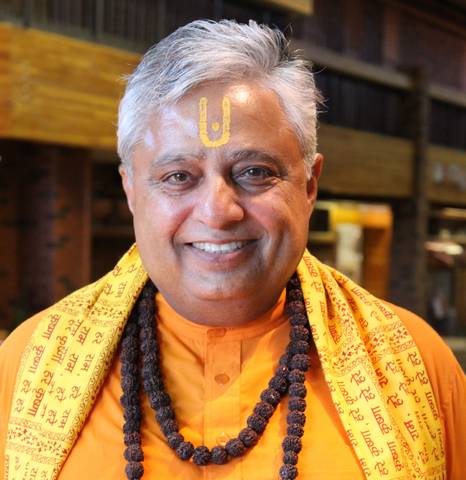

There’s an old saying “never trust a man with a beard”. Sound advice from my clone above btw.