A SELF-MADE millionaire who grew up in Gibraltar is at the centre of a criminal investigation after investors claim to have lost £70 million.

Real estate developer Anthony Armstrong Emery, 37, collected payments of around £20,000 from Gibraltarian, British and Spanish investors for his Brazilian EcoHouse scheme.

Brazilian police are now investigating the EcoHouse Group for money laundering and tax evasion.

The scheme collapsed in October and many now fear their money ‘will be gone forever’.

A British victim who invested £23,000, said she was promised a 20% return on her money over one year.

She said: “For the first few months, it all went well. I got a regular newsletters and the website was always up-to-date.

“When I realised I hadn’t heard anything for a few weeks I tried to call the office number but there was no answer.”

Other investors confirm they have been unable to contact EcoHouse since their UK-based office, in Richmond, was cleared out in October.

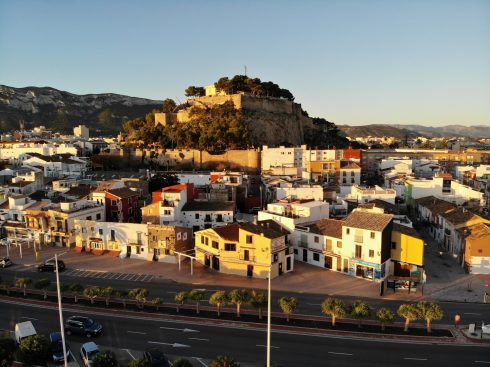

Born in West London, Emery – who is thought to have homes in the UK, Italy, Monaco and Brazil – made his fortune by selling homes to expats in Spain and Gibraltar in the early 2000s.

In 2013, he bought a 98-year-old football team in Brazil, along with struggling Italian football club Monza Brianza.

Emery’s links with Brazil go back to his grandfather, who worked there as a telecoms technician.

Promised 20% over 1 year – Barlow Clowes only promised 15% – unbelievable, simply unbelievable.

Thank you for that comment Stuart ,this was an ethical investment backed by the Brazillian government . It was to build houses for people who lived in slums .

It’s very easy to critise those who invested in a worthwhile project without full information

Cheryl,

to invest without full information – what is/was the track record of the promotors and to expect 20% – ethical investment my a~#e – 20% is pandering to the greed gene.

Sorry on reflection my post didn read well .

Ecohouse claimed and carried the recommendation of Minha casa Minha vida . Portugese for my life my house . We believed it was a government backed scheme and the literature showed this .

Stuart , you misread me or I didn’t make myself clear . This company was working with the Brazilian authorities on Minha casa Minha vida and our funds were paid into a u.k solicitors escrow account for safety .

Sadly the funds appear to have gone , the solicitor will not talk and the goverment of brasil say it wasn’t a registered program .

Cheryl,

you trust lawyers! no genuine scheme to help the poor would promise 20% per annum profits.

Never trust publicity, always do your own research, which, with the internet is easy. An enquiry with any Brazilian embassy commercial dept. would have revealed the truth.

It maybe worth the effort to contact the Solicitors Compensation Dept. But again the get out maybe that the escrow account gave carte blanche for the conmen to ‘legally’ withdraw funds without explanation – as always the devil is in the detail and as always – caveat emptor.

We have lodged a complaint with the SRA and they are investigating the company concerned .

Operation falcon ( met police) are involved as are the Brazilian police .

Cheryl,

good luck for all of you. Maybe I was lucky in having a father who was street wise and I inherited his genes. All my life I have been advised to avoid lawyers at all costs and never ever to trust them – I have found this to be sound advice.

Next time look out for ‘crowd funding’ enterprises they can be very good indeed but once again, it’s worth spending time and some money to avoid getting ripped off.

I agree wth Stuart. The old saying “if it’s too good to be true” etc still applies. Glossy brochures and websites can say anything and it won’t be the first scammer to raid the client account. If it operated in the UK was it authorised or registered with the FSA.

Just ask yourself would they really have to advertise for investors giving those returns.

Thanks Stuart , seriously the avoid lawyers line is a good one and I shall remember it .

I doubt I will invest outside of Isas and the like again , this was my first time and due to the fact a UK Lawyer was involved I stepped right in .

Let’s hope the regulation authorities help all of us . There are over 10.000 investors like me worldwide