MOMENTUM investors need to have a regulated approach to following sector trends in the stock market.

With hindsight it’s not difficult to spot the best trends to follow. Getting it right at the time is the tricky bit.

With hindsight it’s not difficult to spot the best trends to follow. Getting it right at the time is the tricky bit.

Some would say the function of forecasting is to make astrology look respectable. However following the numbers is not forecasting and catching and identifying a rising sector correctly can lead to riches.

To remain successful you must have access to continuous, up-to-date, accurate information. Your decisions should not be based on rumour, speculation and hearsay.

An example of the importance of this goes back to the days of sail. Clipper ships returning from the Far East before proceeding up the English Channel to London would call in at the port of Falmouth at the western end of England. From here they would send coded messages by horsemen to the ship’s owners in London. These messages not only gave details of the cargo of spices, teas and exotic goods but, more importantly, relayed international news. Armed with this information, the traders had a head start on their competitors and would make their decisions and fortunes based on these facts.

Another important mantra to follow when looking at your investment portfolio is that tomorrow will be better than today. Do not get disheartened when you make mistakes and have failures. Treat these occurrences as opportunities to learn.

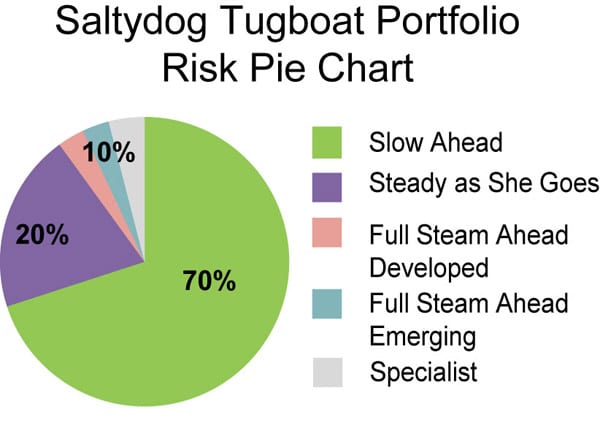

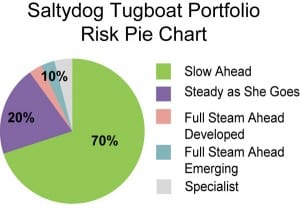

To minimise the effect of any setbacks you must create your own risk pie-chart. You will then avoid the temptation (or innocent default) of ending up with too large a percentage of your portfolio invested in funds which lie in the higher reaches of volatility and risk.

The more volatile your selection, the greater the risk of losing your gains when the trend you are following reverses direction. Investing should be enjoyable and not a do-or-die situation. You will then feel more inclined to keep at it and enjoy the benefits of time and compound interest.

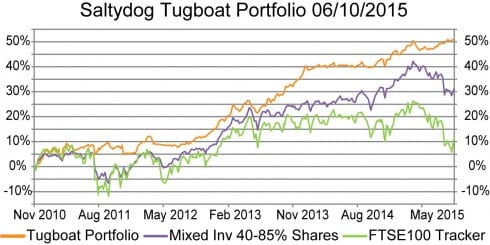

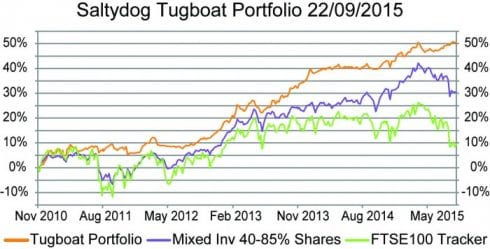

The Saltydog Tugboat portfolio maintains a cautious approach by ensuring that at least 70% of the portfolio is in what we call ‘Slow Ahead’ funds. This has meant that in less than five years our portfolio has gone up over 50%, and we have successfully avoided all the market corrections.

• To find out more about Saltydog Investor, or better still to take the two-month free trial, please go to their website www.saltydoginvestor.com