I FOLLOW the horses; the trouble is, the horses I follow also follow the horses! How many times do you hear people say something along those lines after they have lost their shirt at the races?

More often than not. They put their money on before the race starts, the die is cast, and they have to live with their choices.

The opposite is true of momentum investing, where you can change horses midstream.

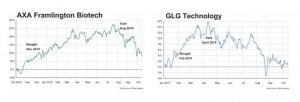

Last month’s Saltydog newsletter looked at the timing of the purchase and subsequent sale of two funds in one of their demonstration portfolios: AXA Framlington Biotech and GLG Technology. These two cases demonstrated very clearly the principle of momentum investing.

Unlike in a horse race, these funds were chosen after the race had started when the funds were performing well; whilst the race was still underway, we decided to ‘dismount’ as both funds started to falter and lose ground. Therefore we still retained the gain between the buying and selling prices.

There were some people who chose to stay the course, hoping that their horse would recover. They are now looking at a situation where the selling price is less than the purchase price. They are in a loss situation. They backed a horse that was following other horses!

As a Saltydog subscriber, with access to all the fund performance numbers and graphs, why should we get tempted to break the rules? After all, buying and selling Unit Trust/OEICs is quick, and virtually free on a supermarket fund platform, while a sale made too early can easily be rectified with a repurchase. So why, myself included, do we end up occasionally running loss-making situations?

It must be down to built-in facets of human nature.

- Inactivity. It’s sometimes easier to do nothing and ignore the evidence.

- Loss aversion. Investors are happy to lock-in a profit but reluctant to lock-in a loss.

- Selective thinking. We give more credence to the facts that confirm the beliefs we already hold, and sideline those that do not.

- Positivity. One of the reasons that the human race still exists, and goes forward, is its ability to remain positive in the worst scenarios. This may not always be the best approach to investing.

These facets are attitudes of mind that I have to take into consideration when looking at my own investments and decision making. It’s only too easy to end up with the horse at the back of the field.

• To find out more about Saltydog Investor, or better still to take the two-month free trial, visit www.saltydoginvestor.com