By Matthew Harris, Cambridge FX

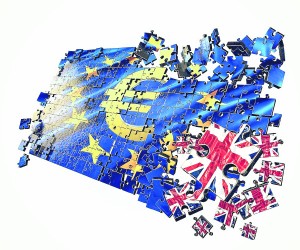

Whilst the author of this piece may have an opinion on the merits or otherwise of a Brexit, this is written as impartial and based on market expectations of what I consider likely to happen solely in the foreign exchange markets in the run up and aftermath of the referendum on 23 June.

Political uncertainty is never good for a currency, and we have seen Sterling suffer tremendously over the last few months, as the Brexit referendum date approaches. I should preface this article by stating that before a June referendum was announced, Sterling had suffered a 12-cent drop from over 1.42, edging under the 1.30 mark in the preceding three months. Whilst that decline was mostly due to interest rate expectation adjustments, it is likely that the potential for a Brexit also weighed on the Pound.

It seems like a long time ago now, but when Cameron successfully renegotiated Britain’s membership terms with the continent, there was relative optimism, as the Pound actually rallied on the news by nearly 2%, challenging the dizzy heights of 1.30 for the first time in 2016. Over that weekend, we saw the referendum announced for June 23rd, and MPs and other senior business and political figures began to take sides, with Boris Johnson crucially joining the leave campaign, giving them the political credibility in a figurehead lacked by other potential candidates such as Farage or Galloway, who have struggled to be taken seriously by the electorate in previous history.

On that news, Sterling began to fall apart, challenging fresh lows, with the gains of 2015 now wiped out – The Eurozone has had a Greek crisis, undertaken a huge Quantitative Easing (QE) programme, and also lost its peg to the Swiss Franc, all of which were major contributors to last year’s gains, and all the effects of them all are now completely over and devoid of relevance to the cross.

If Britain does indeed vote to leave the EU and go it alone, most analysts agree that the Pound is likely to suffer, certainly in the short term. Goldman Sachs are suggesting that it could be as much as a 20% decline in Sterling’s value overnight, which would put levels near parity in sight, as we saw (but did not quite reach) in 2008/2009.

Whilst doubt has a long track record of being very bad news for a currency, fortunately we do have some precedent that we can use to develop an idea of “what happens next”. In 2014, the Scottish Independence Referendum looked incredibly close to most pollsters in the run up to the event, indeed one poll two weeks out suggested that the independence campaign were in the lead for the first time. That poll came out on a Sunday, and when markets reopened on the Monday, Sterling lost nearly 2% of value across the board, though this was quickly recovered when the union remained intact. This is slightly difficult to compare, as the small arm potentially breaking off in the present occasion is now the UK leaving Europe, and crucially, Scotland didn’t have its own currency to measure the effects of such a decision. We can only assume that if consequences were a 2% loss for the larger partner, it would be multiplied for the smaller one, with Sterling likely to suffer even heavier losses against other currencies than it would against the Euro, which would take a small hit itself.

The next event we can have a look at dates back to 2010 when Britain found itself without a government for a few days following the general election that saw the first hung parliament in nearly a century. This was very much an unknown, and there were several outcomes, none of them particularly attractive. When it became clear that this result was likely as the constituencies announced their results, Sterling began to slide, dropping from 1.19 the day before the election to 1.12 the day after. Again, this was corrected when a coalition was formed, though the Pound still found itself worse off compared to how it had been the week prior to polling day.

From the more recent 2015 election, the result was unclear even after the exit poll showed the Conservatives making strong gains. When their majority was confirmed, Sterling rallied as the uncertainty and doubt surrounding the UK’s political atmosphere had been lifted – indeed 2015 was the strongest year in some time for Sterling which was the strongest major currency throughout the year. However, currencies too are not immune from gravity and 2016 appears to be the year we have to pay the piper.

There have been numerous statistics published, mostly by the remain campaign as to the effects of any Brexit, with various doomsday scenarios being painted, the biggest headline grabber to date is that it would cost £150bn by 2020, though we are sure the remain camp will also unveil projected “job loss” figures too nearer polling day. Removing other economic considerations from the debate, the likelihood is that if a Brexit materialises, Sterling is highly likely to suffer considerable losses in the aftermath of a leave vote, regardless of what the long term consequences are for the currency.

One thing we are also likely to see is the markets pricing in any expected outcome – if it becomes clear that one side or another are likely to prevail, Sterling is likely to react accordingly – down in the event of a leave expectation, up in the event of a remain one. However, it is likely that the biggest effect will be saved for when the results themselves come in, as forecasting recent political events in the UK has been difficult at best.

Given that experts are split on what the result is likely to be, the risk of trusting one side over another seems rather high. As a result, for anyone with a large future currency exposure, the question they should be asking has shifted from “What is going to happen with the result” to something more akin to “How do I want to manage the currency risk”.

Whether you are selling Sterling to buy another currency, or have incoming Euros or Dollars to sell back to Pounds, you are likely to be profoundly affected by this event, and it could be a double-digit move. It may be tempting to take the risk that the result (and market) will both be as you want them, but in practice, hope is not a reliable economic tool.

We have seen a significant increase in clients employing hedging strategies to protect themselves from adverse market movement. Hedging isn’t a technical or scary term, in this case it just means contingency planning. The most common strategy is to use a forward contract, which allows you to lock in the exchange rate at the current level, then when you need to use the currency, that is the rate you get. Forwards aren’t for everyone, and you should speak to your account manager about the cons as well as the pros before you decide to take one out. They normally require a deposit of 5%, and if the market moves against the direction you have protected, you may be required to pay an additional deposit or margin call.

If you’re buying a property and have a large amount of Euros to purchase after referendum day, a forward contract will give you the peace of mind of knowing exactly how much you will have to pay, regardless of where the exchange rate sits. Sadly, if the exchange rate rises, you will still be locked in at a lower level with your forward – the purpose of this contract is not to speculate on which way the market will move, but to eliminate this risk entirely and accept the current level.

You can also use other strategies like limit orders and stop losses. These allow you to set a target (limit) or worst case (stop loss) level, so you know your house will not go over budget if the market does move adversely. All of these tools are offered by most currency specialists free of charge, and you should talk through each scenario carefully with a specialist before you commit to any strategy or contract.

To discuss your foreign exchange obligations please email [email protected] or call 0034 952830176