For those who live in Spain right now, economic uncertainty is among the most pressing issues causing headaches and anguish to the population as the unforeseen economic fallout associated with the coronavirus spread continues to affect the country, leaving thousands of people with little or no income while businesses struggle to remain operational.

The latest economic projections from Standard & Poor’s, the US-based financial research firm, predict that Spain faces a 1.8% drop in economic activity by the end of 2020, even though the Bank of Spain has assured that while COVID-19 is capable of triggering an economic slowdown accompanied by negative economic growth, it is “not capable of provoking an economic crisis”

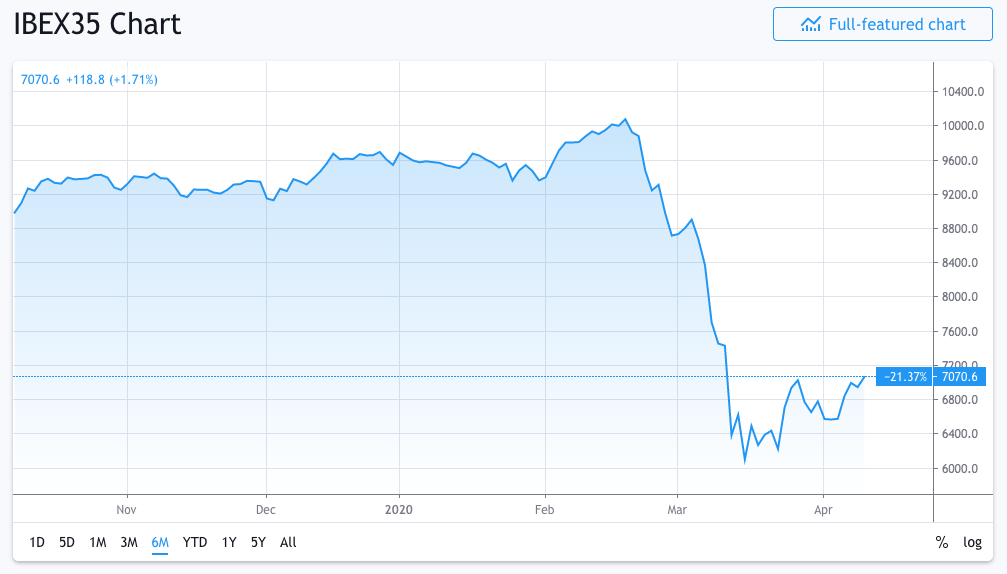

Meanwhile, the IBEX-35 has lost nearly 30% of its value year-to-date, even though it has slightly recovered from its March 16 bottom of 6,107 and it is now trading at 6,923, which results in a 13.3% gain in less than 20 days, as investors expect that the worst is over and the curve of new daily contains might start flattening from now on until the crisis is fully contained.

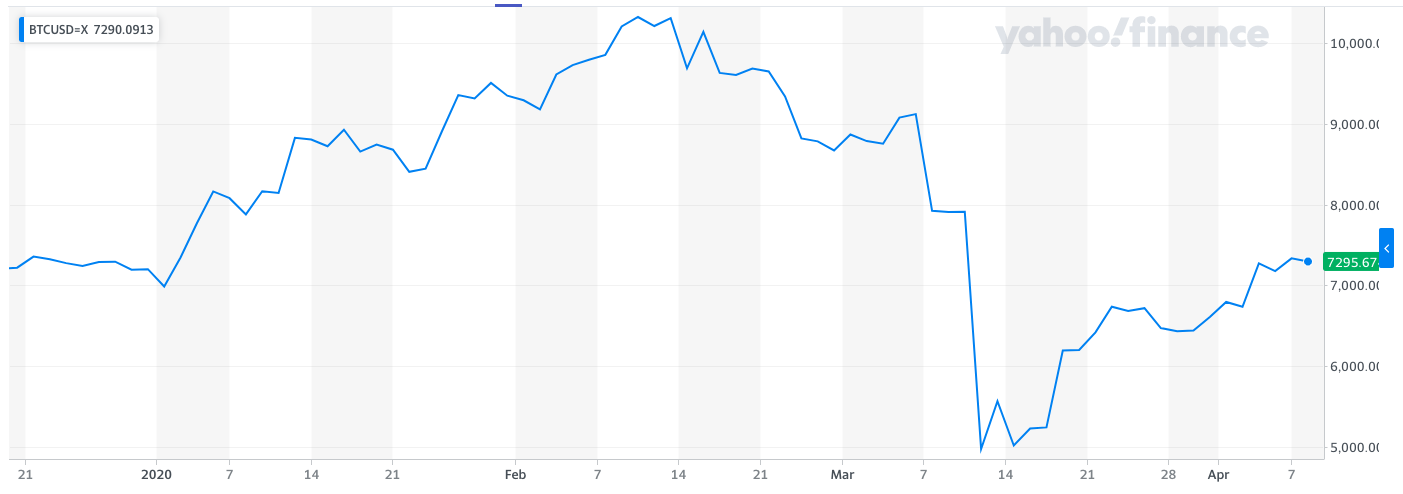

Bitcoin (BTC) value, on the other hand, has also recovered from its year-to-date bottom of $4,970 and it is now trading at $7,295, as this cryptocurrency is going through a major technical event called ‘halving’, which usually has an upward influence in its value if you want to comprar bitcoins.

In this scenario of economic and financial volatility, individuals are faced with important economic challenges they must address such as covering their day-to-day living expenses, managing their investment accounts wisely, and finding alternative income sources that help them in going through this adverse situation.

In this regard, the following article aims to provide a few recommendations on how you can manage your finances more effectively during times of financial turmoil such as the ones we are living right now.

Tips on Managing your Savings

If you currently have an emergency cash fund you can rely on, you are probably living under significantly less stress than a large number of people.

Statistics show that Spanish are saving around 24.1% of their income, which means that some people may be well-prepared to withstand at least a couple of months of living expenses during a situation of zero income.

Meanwhile, others might probably combine the use of their savings with some partial income from their regular jobs.

In this regard, personal finance experts recommend that individuals should use their savings strategically by maximizing all your potential income sources to reduce the amount taken out of your savings account as much as possible.

Furthermore, experts also suggest that people establish a stricter budget during this temporary situation to make the most out of their emergency funds.

Tips on Managing your Investments

Managing an individual brokerage account under a situation of financial distress such as the one triggered by the coronavirus is crucial to avoid making decisions that could affect the long-term performance of your investments.

In this regard, if you currently have an individual brokerage account you use to invest money, whatever the purpose of the account is, you should understand that the current market volatility is not normal and the markets should stabilize at some point in the future.

With this in mind, selling your financial assets at discounted prices such as the ones seen right now is a decision that might cause severe financial losses.

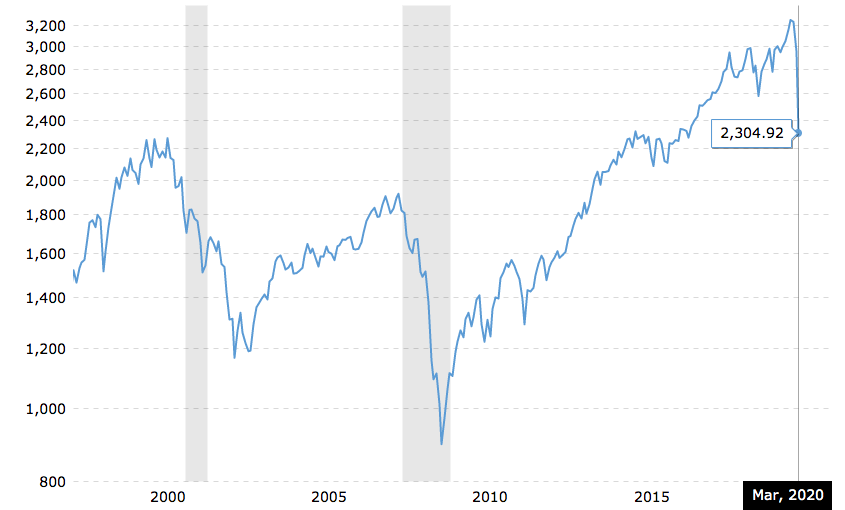

Meanwhile, history has shown that the stock market has managed to recover from past crises in a period between 4 to 5 years, back to where they were before the situation started.

This means that you should consider holding your assets instead of selling them off, as you may be able to recoup your losses in the long run.

Tips on Managing your Income

Spain’s government has announced a series of measures to assists workers who have been affected by the virus or who have experienced a temporary job loss and you can further research this information to identify if you are entitled to receive any of these benefits.

Meanwhile, for those whose salary has been diminished as a temporary measure from their employer to cope with the crisis, there are always freelancing alternatives online that could provide a second income stream to alleviate the effect of this cut.

Bottom Line

Managing your finances during this scenario is crucial to successfully go through this temporary health emergency. By implementing the previous recommendations, you might be able to get the most out of your savings and avoid unwise decisions on your investments, which could ultimately affect your net worth and the achievement of your long-term financial goals.