SINCE Brexit, British citizens require a visa for stays exceeding 90 days in Spain.

Americans have always needed one. For retirees from both sides of the Atlantic dreaming of Mediterranean life, the Non-Lucrative Visa (NLV) has become the most popular pathway.

A growing number are discovering that buying off-plan property creates the perfect timeline to prepare their application, and their new life.

The Non-Lucrative Visa: A Quick Overview

The Non-Lucrative Visa (Visado de Residencia No Lucrativa) allows non-EU citizens to reside in Spain without engaging in economic activity.

It is specifically designed for retirees with pension income, individuals with savings or passive income, and those taking extended sabbaticals.

Unlike the Golden Visa, there is no minimum property investment required.

The key requirement is proving sufficient financial means, currently 400% of Spain’s IPREM index for the main applicant, plus 100% for each family member.

For a couple applying in 2026, this typically means demonstrating approximately €2,400 to €3,000 per month in income or equivalent savings.

Crucially, applicants must provide six to twelve months of bank statements proving liquidity, comprehensive private health insurance without co-payments, and a criminal record certificate.

The complete non-lucrative visa requirements for 2026 are detailed in specialist guides, but the process typically takes four to six months from gathering documents to receiving your visa.

Why Off-Plan Purchases Align Perfectly

Here is where smart planning comes in. Purchasing a new-build property off-plan typically involves a 12 to 24-month construction period. This timeline mirrors the visa application process almost exactly.

Consider the typical sequence: you reserve your property with a deposit, then spend months one and two gathering visa documents including medical certificates, criminal record checks, and financial statements.

By month three, you are arranging translations and Apostilles while construction begins on your new home.

Month four brings your consulate interview, and by month five, you receive your visa with 90 days to enter Spain.

When you finally collect your keys, your residency paperwork is already in order. There is no scrambling to find accommodation while navigating bureaucracy, no temporary rentals, no uncertainty.

Choosing Your Costa: Where to Buy

Spain’s Mediterranean coastline offers distinct personalities across its four main costas, each attracting different types of retirees.

The Costa Blanca stretches from Denia to Torrevieja and remains the most popular choice for British and Northern European buyers.

With over 300 days of sunshine, established expat communities, and excellent healthcare facilities, towns like Javea, Altea, and Calpe offer the perfect blend of Spanish authenticity and international convenience.

Further south, the Costa Cálida around Murcia’s Mar Menor lagoon provides some of Spain’s most affordable new-build options.

The region around La Manga and San Javier attracts buyers seeking value without compromising on climate or amenities.

The glamorous Costa del Sol from Malaga to Manilva draws those with larger budgets who appreciate world-class golf, fine dining, and direct flights from major international hubs.

Estepona and Fuengirola remain particularly popular with American buyers.

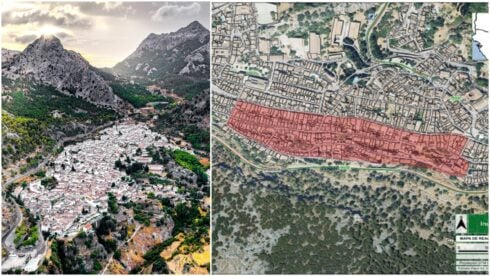

For those seeking unspoiled coastline and lower prices, the Costa de Almeria around Mojacar and Vera offers dramatic landscapes, authentic Spanish villages, and excellent value.

This region is increasingly popular with buyers wanting to escape the more developed coasts.

Modern new-build properties across Spain’s Mediterranean coast offer practical benefits for retirees: high energy efficiency ratings that reduce running costs, ten-year structural guarantees under Spanish law, and contemporary designs with lifts and accessibility features.

Important Considerations

One critical point often overlooked: the Non-Lucrative Visa requires residing in Spain for a minimum of 183 days annually to qualify for renewal.

Spending more than 183 days automatically makes you a Spanish tax resident, meaning worldwide income becomes taxable in Spain.

Consulting an international tax advisor before applying is essential, particularly for Americans who must continue filing US taxes regardless of residency.

The initial visa grants one year of residency, renewable for two years, then another two years, before permanent residency becomes available after five continuous years.

Making It Happen

The dream of waking up to Mediterranean sunshine every day is more achievable than many realise.

The Non-Lucrative Visa provides a clear legal pathway, and aligning your property purchase with the application timeline transforms what could be a stressful transition into a well-orchestrated move.

With proper planning, your visa approval and property handover can coincide perfectly, leaving you free to enjoy everything Spain’s stunning coastline has to offer

Click here to read more Other News from The Olive Press.