ONE of Spain’s top economists, professor Jordi Gual of the Caixa Bank group is optimistic about the year ahead, despite the fragile global economy.

Speaking at a dinner for real estate professionals organised by Amat Immobiliaris, an agency established in 1948, he talked about the oil price crash, slowdown in China, and low interest rates – and the implications for Spain as it emerges from recession after a painful internal devaluation and restructuring, and now faces a continuing political crisis in Madrid.

After reading so many gloomy headlines of late, it was reassuring to listen to a more balanced view from someone with access to all the data. Prof. Gual made it clear he is cautiously optimistic for Spain, describing his position as ‘positive but not naive’, including on the domestic political front.

Without denying the human cost, he explained how Spain has become much more competitive, although the job is not yet over. As a totally open economy, foreign investment has been flooding in to take advantage of Spain’s opportunities, including in real estate. Of course, he stressed, if foreign investors take fright, they can leave as quickly as they arrived.

He also explained how Spanish firms are just as productive as those in other EU countries like Germany when comparing mid-sized and big companies. Spain’s productivity problem stems from its large number of small companies compared to economies like Germany and the UK.

Why so many small companies? Because the administrative environment in Spain discourages companies from growing above a certain size.

GOOD START TO THE YEAR

His optimism was matched by official statistics for January which show the Spanish property market kicked off the year with a blast, as sales surged and house prices increased.

There were 27,568 homes sold in January, according to the General Council of Notaries, an increase of 27% on last year (see chart).

However, the chart also shows that January 2015 was 11% down on 2014, so this January’s big increase might have more to do with weak sales last year than strong sales this year. The hotspots are Barcelona, Madrid and the most popular towns on the Mediterranean coast like Marbella, as well as the Balearics and Canary Islands.

HOUSE PRICES

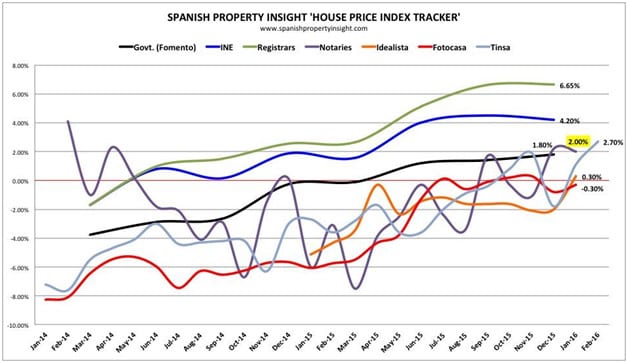

Meanwhile, average house prices (in terms of €/sqm) rose 2% in January on a year before, having climbed from an annualised decline of 6% in January 2015 (and – 8% a year ago in March 2015). There were 11,884 new mortgages signed in January, an increase of 30% over the same time last year.

The chart suggest that, although house prices have crawled back into positive territory (based on the price of property sold), they lack the momentum to rise fast anytime soon. And house prices are still 31% below their 2007 peak, according to this data.

In the context of the SPI House Price Index Tracker, which includes the seven most watched house price indices in Spain, the latest data from the notaries reinforces the picture of Spanish house prices stabilising in mildly-positive territory, after years of big declines.

Conclusion

Sales up 27%, mortgage lending up 30%, house prices up 2%: It looks like January was a great start to the year for the Spanish property market.

• Mark Stucklin runs www.spanishpropertyinsight.com