WE are finding that a lot of banks are pulling out of their 70% LTV deals for British clients as they worry about the implications of Brexit on the exchange rate and possible effect on employment prospects generally.

A good case in point is Banco Sabadell, which has previously been open to this type of business but also has been affected by its somewhat toxic purchase of the British bank, TSB.

Added to this ARE the implications of the new mortgage laws which have become more onerous and, arguably, weighted unfairly against the banks. As a result they are becoming more risk-averse again.

Among the new laws that have inevitably led to banks pulling back on lending relate to the greater difficulty in foreclosing on a non-performing loan and the new rights allowing clients with foreign income to switch the loan to their home currency if there is a material (downward) change in the value of the euro. Both of these could potentially prove to be very expensive for the banks.

With the value of sterling plummeting to historic lows – even dipping below €1.10 in August – Brexit has the banks scared.

What the devaluation of the pound against the euro also means is that buyers in Spain are effectively paying more for their monthly installments.

For those on holiday, it may mean less to spend on ice cream, but for those setting up their new life in the sun, it could have more profound impacts.

With the price of Sterling now dropped, Brits in Spain may be seen as higher risk by banks, and this could see more of them denied mortgages than before.

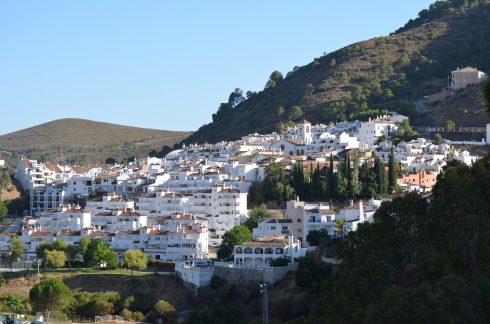

Having said that it is worth remembering that Brexit does not seem to have put Brits off setting up a new life in Spain.

From January to June 2019 there were 7,613 property purchases by Brits in Spain – a 13% increase since the 2016 referendum on EU membership.

However, if you are still worried, there are a few things you can do to ensure you are Brexit-ready for a mortgage in Spain:

- Take into account the effect of exchange rates on having funds available for completion (you will typically need 30% of the price, plus closing fees)

- Calculate carefully that you can afford your monthly repayments taking into account a possible future drop in the exchange rate

- Ensure you have some sound advice from a quality mortgage broker’s like the Finance Bureau, especially at a time of volatile markets