Article by Tracey Storer

WHAT a crazy couple of months we have all experienced, one that I am very sure won’t happen in our lifetimes again. Here’s to keeping everything crossed that this virus is under control!

Whilst we’ve adapted our home lives, working lives and changed the way we go about our day to day business, how has this pandemic effected the world of finance? Let me give you a brief run-down of what has happened so far…

It all started at the end of February when the US markets experienced their worst week since the 2008 financial crisis. The UK markets shortly followed, and 9th March 2020 was labelled ‘Black Monday’ where the FTSE fell from its February highs of 7436, to lows of 4993, a drop in the region of 30%. The biggest losses unsurprisingly coming from the oil and travel industries. The key difference to this market crash was that it was unexpected, unplanned for and largely unprecedented.

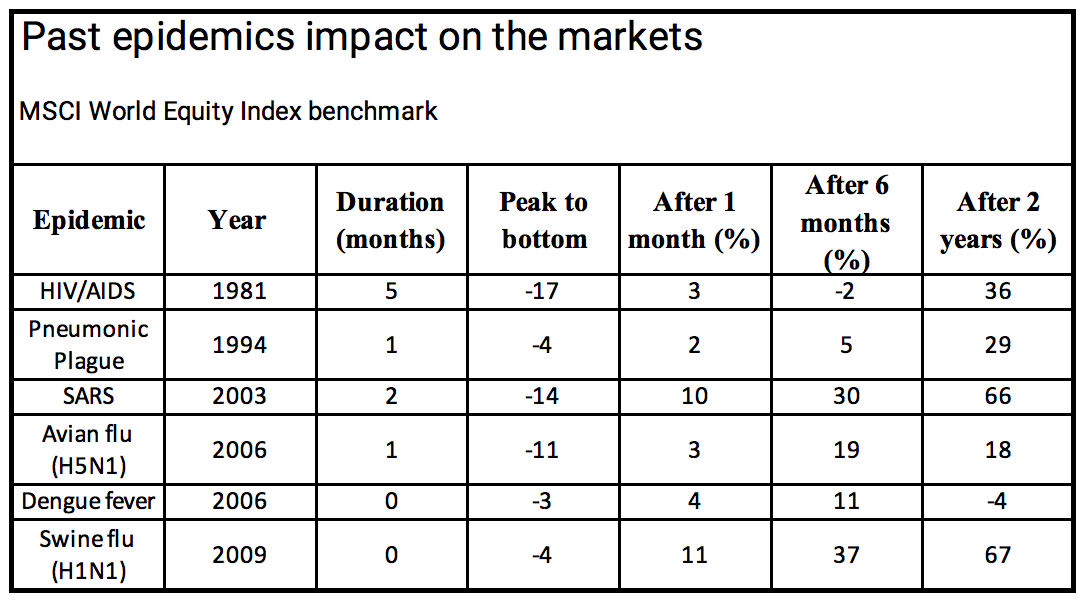

The following table shows what impact previous epidemics have had on the world’s economy.

If we look at the SARs epidemic in 2003 you will see it was quite a dramatic drop but very short lived. Now, SARs is a drop in the ocean compared to the scale of Covid 19, but there are some similarities and things that we can learn from. Firstly, the market drop for both was steep, quick, but short lived, this is mainly because there were no fundamental issues with the financial markets, more of an economic slow/shut down and the markets recovered quickly once the pandemic had ended.

We are already seeing this happen with COVID-19. Despite the initial dramatic fall, we have now seen the markets calm, and history has always proven that at some point a new bull market (recovery) will begin. With that will come many opportunities for people already invested and those that are looking to invest. Let me give you a clearer picture of how a bear market (when the market crashes) then turns into a bull market (period of market recovery) oh and the unicorn…… just really to get your attention!

The 2008 debt crisis was in a bear market for 17 months and lost a total of 57%, but 12 months into the subsequent bull market the markets rose by 68%. Some of you may remember the 1981 inflation crisis, that lasted 20 months and the markets lost 27% but 12 months after the bull market began, the markets had risen 58%. The pattern is clear, we know what will happen, but we don’t know when it will happen and that can make investors nervous.

My advice is this, don’t over think how long the pandemic will last or when the economy will recover, but think more about what sectors or companies can make it to the other side. If you’re already invested, make sure your portfolio is being reviewed, and whilst it is important that you don’t make any knee jerk reactions, it’s at times like these where cracks can begin to show and, in some cases, urgent changes are necessary.

To give you some idea/reassurance, clients of Chorus Financial who have been invested in our balanced portfolio are 5% up over the last 12 months despite this recent crash. That is because we build our portfolios using funds that have exceptional track records, strong performance history and good value for money. The mixture of funds we choose create a diverse spread of assets which helps protect our clients in volatile market conditions. If you are a cautious/balanced investor and your portfolio has experienced greater losses over the last 12 months, then there are likely to be some fundamental issues with the funds you hold, and I would strongly suggest you get a second opinion.

If you are an investor looking to enter the markets, well arguably these are some of the best times, as you are getting a ‘discount’ on funds that you buy into! Always make sure that you receive advice, even if you are an experienced investor, as quite often there can be institutional savings to be made and also a professional adviser will make sure your investments are structured correctly to ensure you don’t end up overpaying any tax.

So, whether you are already invested in Spanish Compliant product such as Quilter International, Prudential, Lombard etc or you may have a QROPs or International SIPP that you would like a second option on, or whether you are looking to get advice on a new investment or a pension transfer please give us a call and we can provide you with an independent opinion. Call Tracy on 693 107 044 or email [email protected]