THE bosses of a beleaguered crypto company ‘took out €11 million’ just months before the company collapsed, it can be revealed.

Documents seen by the Olive Press suggest a Russian and a Gibraltarian withdrew the massive payments from online platform Globix in two big withdrawals.

Sole shareholder Damian Carreras, 39, withdrew nearly €8 million, while his associate Pavel Sidirov, the company’s tech guru, took €3 million, it is alleged.

Most alarming for investors desperate to recoup cash will be the discrepancy between the €40 million claimed to be in the company pot last June and the €13 million that Carreras claimed was left last month.

According to liquidators, €40 million was transferred out of Globix wallets during a period in which the company supposedly had ‘payment processing issues’.

A Gibraltar court has heard that money has even been withdrawn after March 10 when the company was placed in liquidation.

Just two weeks ago on March 23, when liquidator Adrian Hyde discovered a Globix account containing €14 million, on that very same day €4 million mysteriously disappeared from it.

An exclusive Olive Press investigation first revealed the scandal on March 8 – the company went into liquidation two days later – leading to mass panic among investors, believed to number in their hundreds.

The court has now granted injunctions against Carreras and Sidirov from accessing any further monies still remaining in various Globix crypto wallets.

They have also been ordered to hand over all documents regarding Globix, while they are set to be ordered to court as lawyers talk of ‘compelling’ evidence of fraud.

Suspiciously, the injunction specifically prohibits any third-party ‘persons unknown’ from accessing the funds.

When reached this week, Sidirov told the Olive Press he merely helped to set up and develop the Globix system and is innocent of all charges.

He said: “I was a freelancer hired to help develop the system together with a Ukrainian company. I received a maximum of €200,000 to €300,000 from Globix.”

He added he had no idea how much Carreras had taken. “He is the owner of the business and had the right to withdraw anything.”

Meanwhile, liquidators in charge of unravelling the crypto fraud no longer believe the account told by Carreras and Sidirov that a Ukrainian IT company had hijacked the Globix system.

They labelled it ‘not reliable’ and deemed plans to fly to Kyiv to speak to police there a ‘wild goose chase.’

Globix took in millions of euros during 2021 and the start of 2022 from investors keen to capitalise on its so-called algorithmic technology that seemed to return constant winning trades.

But by the middle of last year the company had stopped allowing users to access their funds, leading to a string of angry investors in Gibraltar and Spain fearing for their cash.

A criminal incident with Sidirov last June led to a situation in which the Russian national claimed to have activated a failsafe mechanism that had sent the Globix system to an IT company in Kyiv.

Due to the war with Russia and the various supposed complexities of accessing the crypto wallets now in the hands of an IT company from Kyiv, progress was reported to be very slow.

In January it was further reported that the CEO of the Kyiv company along with two other employees had even been arrested by Ukrainian police.

This story was used to explain why Globix could not allow worried users to access their funds, but court documents now appear to debunk this explanation.

“I wake up in the middle of the night because of all this,” one anxious investor told the Olive Press.

“A very significant proportion of my net wealth is invested with Globix. I can’t tell you what a nightmare the last six months have been.”

Whether the Globix saga will prove to have a happy ending for investors remains to be seen.

Meanwhile, the Rock has launched its Gibraltar Recovered Assets Fund to collect and manage money taken from economic criminals.

The fund will then pay for specialist training and development of the departments in the Royal Gibraltar Police and Customs that are charged with combatting such behaviour.

“The establishment of the Gibraltar Recovered Assets Fund marks an important milestone in our ongoing commitment to ensure transparency, integrity, and the rule of law in Gibraltar,” Chief Minister Fabian Picardo said.

“By reinvesting the proceeds of crime into the fight against economic crime, we send a strong message that Gibraltar is not a safe haven for criminals and their illicit gains.”

READ MORE:

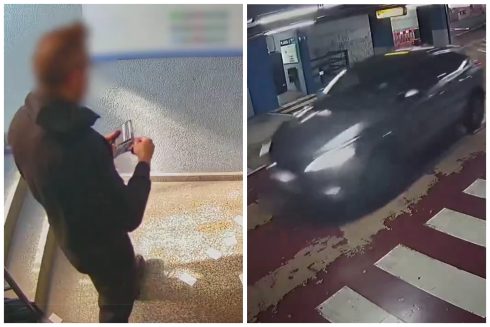

- Liquidators probing whether crypto exchange Globix was ‘a fraud or Ponzi scheme’ as the CEO flees to Barcelona

- EXCLUSIVE: Giant crypto exchange Globix goes into liquidation amid rumours of missing €70 million

- Kidnap, crypto and Ukrainians: The multimillion-euro scandal that looks to have defrauded hundreds in Spain and Gibraltar