By Mark Stucklin of Spanish Property Insight

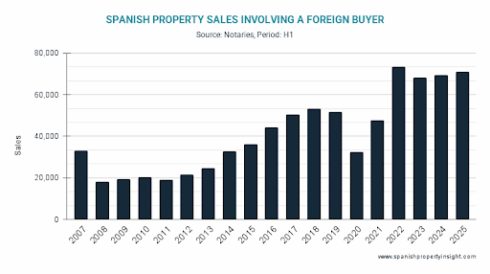

FOREIGN appetite for Spanish property continued to boom in the first half of 2025, according to the latest figures from Spain’s notaries, marking the second-highest number of foreign purchases on record for a six-month period.

A total of 71,155 home sales involved a foreign buyer, up 2.5% on the same period last year and a hefty 26.5% above the ten-year average. Only the first half of 2022 saw more, when the post-lockdown rebound inflated the figures. Strip out that exceptional year, and 2025 would be the strongest H1 ever recorded.

But while foreign buyers remained highly active, local demand grew even faster. Spanish buyers increased their purchases by 10% to almost 300,000 homes, pushing domestic sales to their highest level since before the pandemic. That surge meant the foreign share of the housing market slipped to 19.3%, down from 20.4% a year earlier.

The biggest markets

The UK remained Spain’s largest foreign market with 5,731 purchases, followed by Germany (4,756), Italy (4,513) and France (3,980). Together, these four countries made up roughly a third of all foreign sales.

Other significant players included the Netherlands (4,166), Poland (2,768), China (2,575), Belgium (2,908) and Ukraine (2,165), reflecting the wide spread of international demand for Spanish property.

Winners and losers

The standout growth came from Portugal (+24%), the Netherlands (+19%) and the United States (+15%), all showing double-digit gains helped by lifestyle migration trends and strong currencies against the euro.

By contrast, Russia (-17%), Poland (-11%), and Argentina (-7%) were the biggest fallers, while Belgium (-5.5%) and the Nordic countries (Sweden and Norway, both around -2.4%) also softened. Even the once-dominant UK market declined by -2.3%, extending a slow slide that began after Brexit.

A maturing cycle

The overall picture is one of resilient but stabilising foreign demand. After years of rapid post-pandemic growth, the market now looks to be entering a more mature phase, with steady sales volumes but slower momentum in some traditional source markets.

Early signs of a slowdown

However, the notary data only covers the first half of the year. More recent figures from the Housing Ministry – which provide a quarterly breakdown – suggest the market may already be cooling.

While foreign demand was marginally higher overall in H1, foreign sales fell 6% in Q2, driven by a 14% drop in purchases by foreign non-residents buying second homes. That’s quite a slump in sales after a strong period of growth.

In short, Spain’s foreign-buyer boom rolled on through the first half of 2025 — but the latest data hint that the tide may now be turning.

Mark Stucklin is the owner of Spanish Property Insight. Read more from Mark here.

Click here to read more Property News from The Olive Press.

You say FOREIGN buyers are buying in Spain. Surely the majority are EUROPEAN not foreign. Russian, Chinese, USA buyers are FOREGN.