By Peter Dougherty

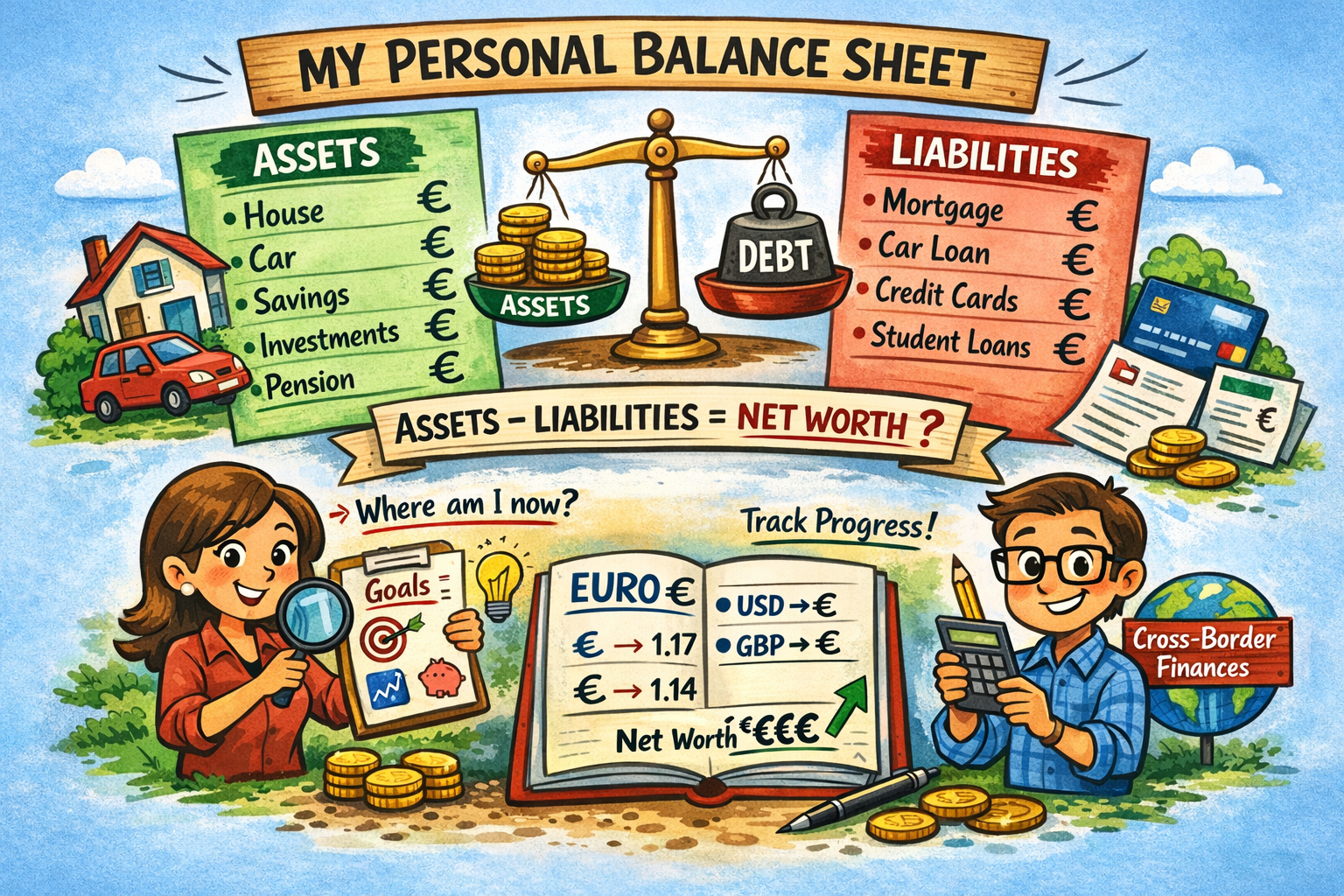

NO matter where we live, personal balance sheets answer the important question of where we stand financially.

They are a snapshot of what we own (our assets) minus what we owe (our liabilities). As with any road map, we first need to know where we are before we can figure out where we’re going.

At BISSAN Wealth Management, we include a balance sheet in every financial plan we create.

I studied the balance sheets of corporations as part of my MBA curriculum – thankfully, personal balance sheets are simpler, they don’t follow the formal rules and categories necessary in a corporation’s balance sheet.

So, why would we want to put together a balance sheet for ourselves?

-Gives us an awareness of our financial position

-Allows us to set financial goals

-Assists us with decision-making for investments and debt

-Enables us to track our progress over time

What are the steps in making a personal balance sheet?

We start by writing down all the things of value that we own on the left side of a sheet or spreadsheet.

Even if we owe money on them, such as our house or apartment, we put them on the list.

The number we record should be today’s fair market value. That’s the price a willing, knowledgeable buyer would pay.

It may be more or less than we paid for the item, but it is the best measure of its current worth.

For bonds, stock options and retirement accounts, we use the current value, not the value at maturity or the value on the date we are fully vested.

And we should list only those life insurance policies that have a cash value.

Any loans related to these items will be included in the liabilities section (right side), so our equity – the amount that’s ours – will not be overstated.

It’s important that all amounts listed on our balance sheet be converted to a single currency.

For expats in Spain, that should be euros. Consequently, we need to add a column to our sheet or spreadsheet.

If we have assets in the US or UK and thus a statement lists them in dollars or pound sterling, we should use this extra column to convert those sums to euros.

That means sums shown in dollars should be divided by a number (today, that number is 1.17) and those shown in pounds should be multiplied by a number (1.14, on the day this article was written).

Currency exchange rates change frequently, so we should update our balance sheet to reflect the current value in euros periodically.

Once we have recorded what we own that has a monetary value, we need to consider the money we owe banks or credit card companies for items such as our car or house.

We list these on the right side of the sheet. We also need to record the money we owe to other creditors – such as student loans.

Just as we did with assets, we should add a column and convert sums that are listed in dollars or pound sterling to euros. These numbers on the right side are our liabilities.

After we have listed all the items we can think of, we total the assets and then total the liabilities and subtract them from the assets.

If the number is positive, (assets are greater than liabilities), we should congratulation ourselves, we have a positive net worth!

Although we often need a passport to travel between jurisdictions, our cross-border financial statement just needs a pen and paper (or spreadsheet).

You can start making yours today.

Peter Dougherty is a Financial Planner at BISSAN Wealth Management in Spain. He holds an MBA in finance from Columbia University in New York and an MS in Spanish Taxation (Máster en Fiscalidad y Tributación) from Nebrija University in Spain. He is a European Financial Planner (EFP) in Spain and is a CERTIFIED FINANCIAL PLANNER™ professional and a Chartered Retirement Planning Counselor® in the United States.

For more information: https://www.financial-planning-in-spain.com

Peter Dougherty

- MBA in finance

- MS in Spanish taxation

- BS in Economics

- European Financial Planner in Spain

- Chartered Retirement Planning Counselor® in U.S.

- Author of two financial planning books

- Certified Financial Planner™ in U.S.

Click here to read more Sponsored News from The Olive Press.