By Peter Dougherty

FROM time to time, I get asked what it took for me to become accredited as a European Financial Advisor and later as a European Financial Planner in Spain.

Seldom do I mention that the European Financial Planning Association (EFPA) sets the standards for financial advisors and planners throughout Europe, or that Spain’s branch is EFPA España.

Nor do I discuss the other credentials that EFPA España bestows.

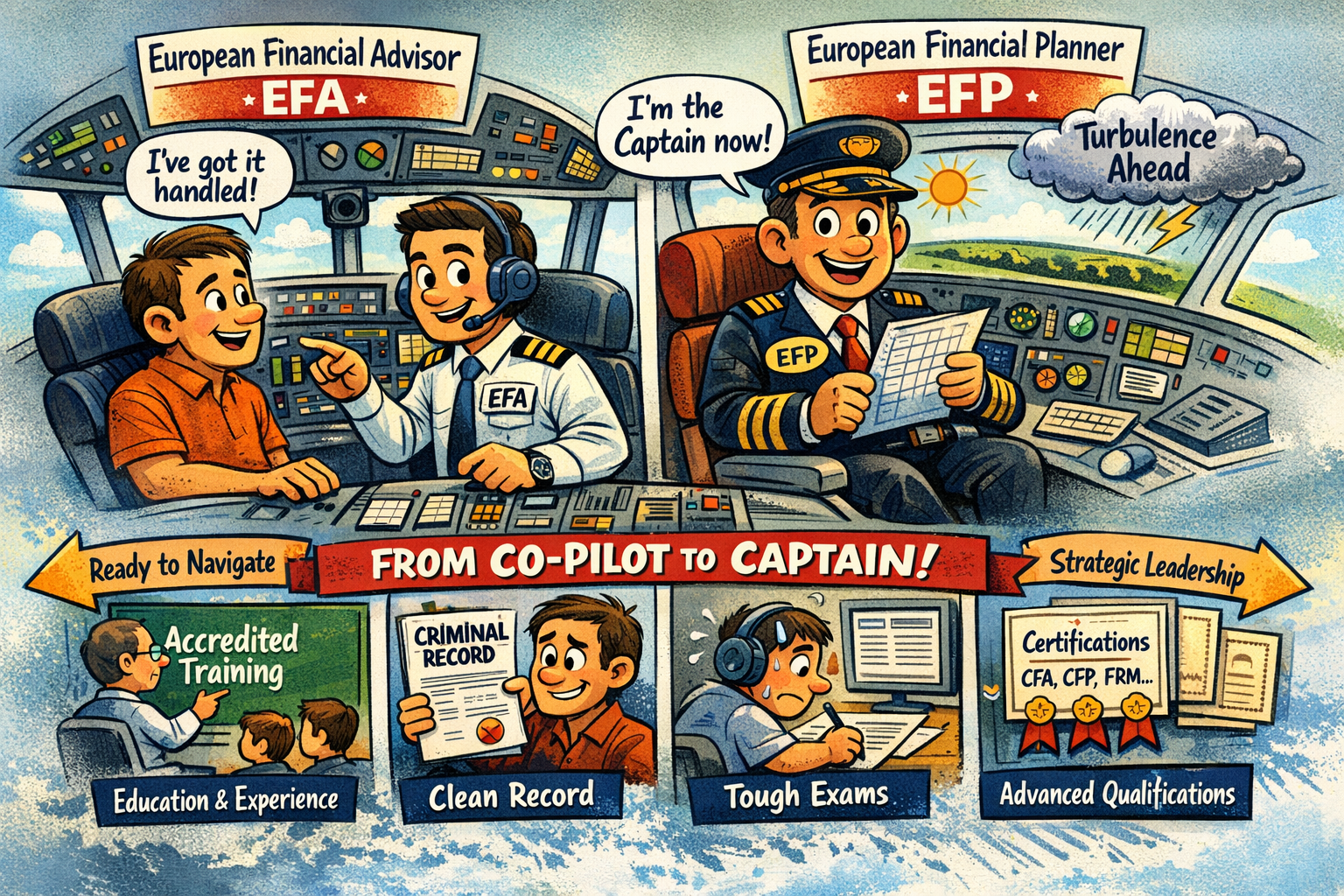

Instead, I tell the story from a client’s perspective and employ an airplane analogy: that a European Financial Advisor (EFA) is like a co-pilot who sits next to you and helps navigate day-to-day financial decisions safely and competently.

In Spain, that means:

- They have spent enough time in the cockpit – one year in the financial services sector, or six months if they’ve completed a preparatory course at an accredited school (there are currently 16 in Spain). The educational program should be covered in a minimum of 20 classroom days or 160 tuition hours

- They are trusted to fly – no criminal record or professional sanctions

- They have passed the simulator test – a comprehensive 2 ½ hour exam

- They know the flight instruments – investments, pensions, insurance, regulation, client advice

When is a EFA in Spain ready to become a European Financial Planner (EFP) and move into the captain’s seat? Typically, once they are capable of:

- Designing long-term, integrated financial strategies for clients

- Handling high-complexity, high-net-worth situations

- Balancing investments, tax planning, succession, risk, and goals—all at once

EFPs need to see the whole flight plan, anticipate turbulence, and make strategic decisions when the stakes (and portfolios) are large. Thus, that means:

- They have spent significant time in the cockpit – one year in the financial services sector, or six months if they’ve completed a preparatory course at an accredited EFP school (there are currently only 5 in Spain). The educational program should be covered in a minimum of 40 classroom days or 320 tuition hours

- They are trusted to fly – no criminal record or professional sanctions

- They already possess a valid European Financial Advisor (EFA) certification or hold one of the following professional certifications/qualifications, provided they were obtained within the last ten years: CFA, CEFA, FRM, CAIA, CIIA, PRMIA, or CFP

- They have passed the Top Gun flight test – a comprehensive six-hour exam

In Spain, European Financial Advisor (EFA) and European Financial Planner (EFP) are not competing certifications but complementary milestones.

EFA establishes technical competence and regulatory trust. EFP builds on that foundation, confirming the ability to integrate, prioritize, and lead.

EFPA España requires that its EFA and EFP holders adhere to a strict code of ethics as well as mandatory continuing education obligations: currently 30 hours a year for EFAs and 35 hours a year for EFPs.

Final boarding announcement: the EFA and EFP exams given by EFPA España are all-in-Spanish, and every rule, concept, and acronym belongs squarely on Spanish soil.

If your financial instincts are jet-lagged from another jurisdiction, they’ll need to adjust before takeoff.

Peter Dougherty is a Financial Planner at BISSAN Wealth Management in Spain. He holds an MBA in finance from Columbia University in New York and an MS in Spanish Taxation (Máster en Fiscalidad y Tributación) from Nebrija University in Spain. He is a European Financial Planner (EFP) in Spain and is a CERTIFIED FINANCIAL PLANNER™ professional and a Chartered Retirement Planning Counselor® in the United States.

For more information: https://www.financial-planning-in-spain.com

Peter Dougherty

- MBA in finance

- MS in Spanish taxation

- BS in Economics

- European Financial Planner in Spain

- Chartered Retirement Planning Counselor® in U.S.

- Author of two financial planning books

- Certified Financial Planner™ in U.S.

Click here to read more Sponsored News from The Olive Press.