By Anatoly Kurmanaev

A SPANISH bank is trying to repossess the home of a British couple who defaulted on a loan.

In the alarming move, Carol and Ian Chatterton face losing their English cottage for not repaying a mortgage on their holiday home on the Costa del Sol.

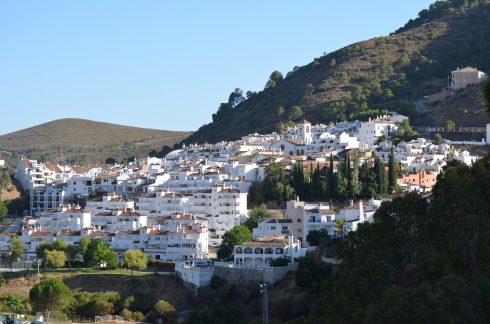

It comes after the Chattertons took out a 150,000-euro (145,000 pounds) mortgage with Banco Sabadell to buy an apartment in Estepona in 2004.

But after they began to fall behind on payments last year, Sabadell resorted to new EU laws to get its money back.

In a move that will send a shiver down the spines of thousands of British homeowners in Spain, the bank have managed to get a European Enforcement Order (EEO) to seize the couple’s home in Wiltshire.

A notary in Marbella passed the order to Wiltshire county court, which has since issued an interim charge on the property.

The couple, who are both NHS paramedics, have lived in the 320,000-euro three-bedroom cottage near Chippenham for 20 years.

“We’re devasted,” Carol, 48, revealed. “And there are thousands more Britons in our position. This is a time bomb waiting to go off.”

The county court is due to make the charging order absolute this week.

After that the bank may force the sale at any time.

This will mean Halifax, which holds the mortgage on the couple’s Wiltshire home, will receive all the money outstanding and Sabadell will pocket the rest.

Interestingly, the Spanish bank has refused the couple’s plea to take flat in Duquesa instead.

The glut of unsold Costa del Sol properties has clearly made the offer less appealing than going after their UK property.

An EEO is meant to be used for uncontested claims in civil cases.

But in Spanish law, a buyer taking out a mortgage gives up the right to contest the debt, and this is taken as evidence of agreeing to the EEO.

When the Olive Press contacted Banco Sabadell it insisted it was the first it had heard of the case.

A press officer said: “Send me an email and I will look into it.”

When we were looking for property in 2003, one Costa del Sol estate agent in particular tried to persuade us to take a hefty mortgage to buy a more expensive property.Despite our insistence that we were only prepared to buy within the price range we could manage without a loan, they tried to persuade us with promises of rental income and unrealistic growth projections.

In fact they failed to show us a single property within our price range during the whole week we were here with the sole intention of buying. Whenever we picked a property we could afford they claimed they couldn’t make contact with the owner. I feel sure many people would have caved in under the constant pressure and now face the possibility of financial ruin, especially given the fact that UK property has dropped in value as well.

Surely agents who employed these high pressure sales tecniques should be held responsible for their actions too?

Why exactly is this so alarming?

If you don’t pay back a loan as agreed then expect the bank to try and get its money back, that is the bank’s duty – to its other customers at the very least! If the small-print on that loan does not link it to any property in particular then the bank is perfectly entitled to try and recover its money as it sees best.

Why should the rest of us who don’t over-extend, and who do keep up with our payments have to pay more for our loans because people like the Chattertons expect to get away with it when they don’t service theirs?

As I understand it, in Spain, if you cannot pay your mortgage, the bank can repossess your property and sell it at market value at which point you become personally liable for the difference between the amount they achieved in the sale and the amount you borrowed.

Why is this unfair? Why should people be able to buy a property abroad and then give it back to the bank when they can no longer afford it, expecting that to be the end of it?

If everyone could just give their properties back to the bank when they couldn’t afford the payments, the country would be in an EVEN worse state than it is now!

I agree with guirizano. If they used their home in the UK as part security for the mortgage, the Bank have every right to claim it. The tone of the article seems to be accusing the Bank of being somehow underhand; ‘managed to get an EEO’ – if this is only meant to be used in ‘uncontested civil cases’ does this mean that the Bank wrote repeatedly to the Chattertons but they just ignored the letters, thinking that the Bank would just re-possess the flat in Estepona? If they can afford to live in a £320K 3-bedroom cottage in Chippenham, they are more well off than a lot of others in a similar situation.

I agree-this is not a ‘Repossession Timebomb’ as headlined-it is perfectly normal activity between a bank and defaulting borrowers. You mortgage your property to a bank, then default and they are obliged (to their shareholders and depositors) to take all reasonable steps to recover their money. Beats me why people think they can just walk away from their mistakes and leave the problem with someone else. I believe they have a £250k mortgage on their £300k house in the uk that they bought 20 years ago-probably for about £100k.So what has happened to all the equity? Seems they have been living beyond their income for years and now expect sympathy when the music stops. Crazy

ha ha

As I understand it, Banco Sabadel have made a pragmatic choice of which property to go for whereas the Chattertons presumably felt that the mortgage they can’t pay related in the first instance to the Estepona property so they would understandably have thought that the Estepona flat would be repossessed and sold and any unpaid balance would have been pursued in the UK. The Bank have merely cut out the first step, presumably becasue of the terms of Spanish mortgages not because they borrowed against the UK house.If I had 2 homes in the UK one with a mortgage in alousy area and one without in agood area I would not expect a bank there to choose the best selling house.However, to have little sympathy with people who don’t repay debt.

It’s folk like the Chattertons that look down their noses at the likes of you and me who pay our bills and therefore may not look quite as flush as they do.

Everyone on the planet who borrows money knows that it should be paid back, I bet they took it quick enough.

Banks can be sharks but please, why shouldn’t they get their money back after all it’s not just a few shillings is it?.

“This will mean Halifax, which holds the mortgage on the couple’s Wiltshire home, will receive all the money outstanding and Sabadell will pocket the rest.”

As I understand that Halifax Bank holds the 1st mortgage on the Wiltshire home. Not that Sabadell gave them another mortgage in UK to buy home in Estepona, together with a non-residente 70/80% LTV mortgage. I suppose that depends how much is Sabadell after? Mortgage owned & unpaid + legal costs over the home in Estepona, and how much did they got of it at the auccion… any remaining amount is what Sabadell is after. What I dont understand is how can they obligate the auccion when the first mortgage provider has not been unpaid. Halifax has got all their payments. If this would be in Spain, the 2nd mortgage provider would have to wait until the 1st mortgage is paid of, or that the 1st mortgage provider take the owners to court for unpaid mortgage -> auccion, when the received monies would be split between the parties involved. And, if any monies would be left over after paying all the duties, this would be for the house owners, since the house was always theirs.

But its true, many dont realize that Spanish mortgages dont stay in Spain when not paid or satisfied even after auccions.

What no one has mentioned is that they were playing the very British and very dangerous game of ‘property speculation’.

I’ve bought shares and traded currencies – realised I’ve made a mistake – and got the hell out fast – making a small loss – you can’t do that with property.

I have no sympathy at all with those who seek to make a killng from residential property. Here in France there are many British and Irish speculators who thought that property was a one way bet, just like in Spain.

Their potential purchasers – the Brits/Dutch and Germans are’nt buying and the majority of these properties are in the beautiful regions of France where there is no work and the French don’t want to live, so no way out there.

In Spain the vast majority of the 1.3 million crap apartments are not where the work is – Barcelona/Madrid/Bilbao prices have held up well – until the ECB rates go up.

I read in the FT that the ‘expected’ Spanish (not foreign) mortgage defaulters would top 181,000 this year and that was before the latest 0.25% rate hike – the first of many.

Like I say no sympathy for the speculators who must be experiencing rapid bowel movements every day now.

What I don’t understand is why there are so few repossesssions in Spain. The banks obviously don’t want the losses on their balance sheets but there are thousands of properties which have been left, or where owners have high levels of negative equity and where the banks have got judgement against them but refuse to action the judgement. In my opinion the Spanish banks have yet to face up to the apocalypse which is heading their way. Wait and see I supppose this timebomb has yet to be detonated.

Bryan,

this is what the Spanish cannot face upto. Their property crash has yet to happen and it will be far worse than anything in the USA.

There are some very attractive areas in Michigan where you can buy a detached home for less then $1000 as long as you don’t need employment.

Just think of all the young Spanish who took out 50 year mortgages at the hight of the boom, when they see that their investment is worth 25-30% of the price they paid – the sound of their keys being thrown through the doors of Spanish banks will be deafening.