The premise of this article is the contradictory case of a British tax resident of Spain who does not exist for the Spanish tax office – confusing, I know…

However, the idiosyncrasies of Spanish bureaucracy often lend themselves to these perplexing situations.

A client selling his property – a resident of Spain for 20 years – found he did not exist in the eyes of the Spanish Tax Office, because as as a retiree, he had never been obliged to file a tax return here.

Therefore, he would not be given a Tax Residency Certificate, necessary to avoid the 3% capital gains tax retention on the proceeds of the sale.

Adamant that Spain was his place of retirement – and tax residency – he was not going to let the tax office get away with it.

In the knowledge that in the Costa del Sol, if you submit a query to three tax/legal professionals you end up with four opinions, we told him about the Hacienda’s binding consultation service – the ultimate official opinion on a tax matter.

His case was submitted to the Directorate General of Tax (DGT) for a definitive decision.

This was their response:

1. The main document that proves tax residency in Spain is the Tax Residency Certificate.

2. The issuance of an individual Tax Residency Certificate is subject to the applicant proving his/her residency in Spain.

3. Where the above certificate cannot be obtained, the onus of proving Spanish residency lies with the taxpayer who will be able to submit, in support of his claim, alternative evidence: certificate of empadronamiento (Padron registration), children’s school enrollment applications, rental payments, water and electricity receipts etc.

4. The Spanish Tax Office, based on the widely-accepted judicial ‘principle of free evaluation of the evidence´ will determine whether the applicant is or isn’t a tax resident of Spain.

I have also found a certificate of non-residency from the tax office of the country of origin adds considerable weight to applications, so consider this a fifth point to remember.

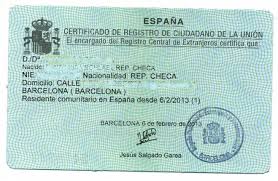

Finally, note that the Spanish Tax Office has not commented on the EU residency forms issued by National Police stations; this is probably because it is not that relevant in their eyes.

Click here to read more News from The Olive Press.

It seems highly unlikely that the client “had never been obliged to file a tax return here” purely because he was retired. At the very least, he would have had to make a declaration in his first year of residency. And if he receives income from more than one source, e.g. a pension & interest on savings, he should be making annual declarations surely, regardless of whether or not he is liable to pay any tax here?

Having said that, I had the same problem of hacienda refusing a tax residency certificate, except that in my case, I had made a Spanish tax declaration for 17 years prior to selling a property for which I needed the certificate. However, because in the year prior to the sale I had not earned enough to actually have to pay tax (which is why I had to sell the property!) they said I was not entitled to a certificate of tax residency!

After obtaining (with some difficulty) a certificate of NON-tax residency from my country of origin (not something I believe hacienda would ever consider giving to a Spanish citizen who had been living outside Spain for 20 odd years) they reluctantly, and not without some attitude, relented and gave me the certificate.

The facts of these cases sadly point to this approach being just another sly way of trying to prise funds out of unwitting foreigners. Think 720!