A LETTER received recently from a reader has prompted me to cover this subject to try to clarify any misconceptions.

June 30 is the deadline for filing your tax returns in Spain for Income Tax and Capital Gains Tax so if you have not already done so, you will need to complete this now to cover the calendar year ending 31 December 2014.

The letter was saying that having lived in Spain for 3 years, tax returns had been completed in the UK each year and tax paid – however, they were now being asked to pay tax in Spain as well – paying tax twice on the same income!

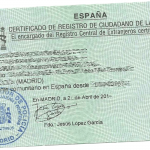

Let’s be clear; Tax Residency is not a matter of choice but rather one of fact. If you have moved to Spain and now spend more than 183 days per calendar year in Spain, then you are Tax Resident in Spain and should file your returns (including M720) and pay your taxes in Spain accordingly. This should include your worldwide income and gains, not just those arising in Spain.

There are however some circumstances when a tax return still needs to be considered in the UK. Many people have retained a property in the UK for example and they are receiving rental income. This may be managed by a UK agent and tax may even be deducted from the rent unless you have an agreement with HMRC as an overseas landlord in which case you can receive the rent gross. If this is below your UK personal allowance, there will be no UK tax to pay. If this is the case or if the rental income is sufficiently high to exceed the personal allowance and some tax has been paid in the UK, the income still needs to be declared for income tax purposes in Spain and if Spanish tax is due, typically any tax paid in the UK will be offset against or potentially reclaimed from the UK.

The purpose of the Dual Tax Agreement between countries is to help to avoid double taxation arising on the same income or gains.

Just to add one slightly confusing addition, certain types of pension income are exempt from tax in Spain where they arise from UK Government employee schemes – for these arrangements, the point of taxation remains in the UK, even if the individual concerned is Spanish Tax resident.

For the person who has already paid UK tax over the last 3 years and is now being asked to pay tax again in Spain, it sounds as though they have been subject to an investigation of some kind which has highlighted the non-declaration in Spain. If this is the case, whilst there are likely to be penalties levied in Spain, they should be able to reclaim the UK.

These are general principles only and should not be relied upon by any individual – you need to consult a tax specialist in Spain to be absolutely sure you are fully tax compliant.