A FEW months ago I mentioned a two-day course I attended in London last December, the start of my training to become a Registered Life Planner with the Kinder Institute of Life planning, which is the most recognised and long established organisation of it’s kind in the world.

Its founder George Kinder is internationally recognised as the father of the Life Planning movement, and has himself been a practicing financial planner and tax adviser for 40 years.

I then went on to write how my father’s death inspired me to become a financial planner, helping people ensure their money didn’t run out before they did, yet also having the life they wanted with the money they had.

A strong desire to enhance my skills as a financial planner, led me to decide to continue my training with the five-day residential EVOKE™ course.

With the outbreak of coronavirus it looked like my progress was to be temporarily halted, as the course in the UK I was due to attend had to be cancelled.

However, in a world first I am pleased to say that I have just completed the course online via Zoom with six other pioneers, all highly qualified and experienced financial planners from the UK.

Life Planning connects the dots between our financial realities and the lives we long to live.

The Kinder Institute’s tools and training make it possible for trained financial life planners to help individuals cultivate a Life Plan designed to deliver the most meaningful kind of freedom: The freedom to pursue life’s passions, wherever they may lead.

EVOKE ™ stands for the five stages for developing a life plan – Exploration, Vision, Obstacles, Knowledge & Execution.

Most of the life planner’s time will be focused on working at a deep level in the first three of these, then using their knowledge and experience in financial planning to deliver – or execute a life plan for a client.

Before starting to develop their life plan, I will ask my client to do some ‘homework’ – including writing down as many of their life goals as possible, broken down into short, medium and longer term goals, as well as their ‘heart’s desires’.

I will also ask them to answer three key questions.

In the Exploration meeting we are trying to create a framework where the client is eager to pour forth everything that might be remotely significant to creating their financial life plan.

Vision is where their life goals and heart’s desires will be explored along with their answers to three questions, the majority of the time being spent on the last one.

Such is the power of these three questions – particularly the last one, as it encourages people to have a good look at the most important aspects of their lives, and it has inspired thousands of people to start new careers, take early retirement from their businesses and have experiences they will remember the rest of their lives.

The third Obstacles meeting is where the rubber meets the road.

Henry Ford said that ‘obstacles are those frightful things you see when you take your eyes off your goal’.

This could not be more pertinent in the current pandemic, which is currently ruling most of our lives.

The Obstacles stage is often the most exciting – it’s where things really begin to happen.

Where all the excuses we had for inaction, all our apologies, doubts and regrets, all our resentments, blames and complaints not only fade away but are actually transformed into action – action on all the things we care about most in our lives.

Naturally the successful execution of the life plan will depend on certain action steps being accomplished at certain times – any slippages in either of these crucial elements may put the whole plan at risk.

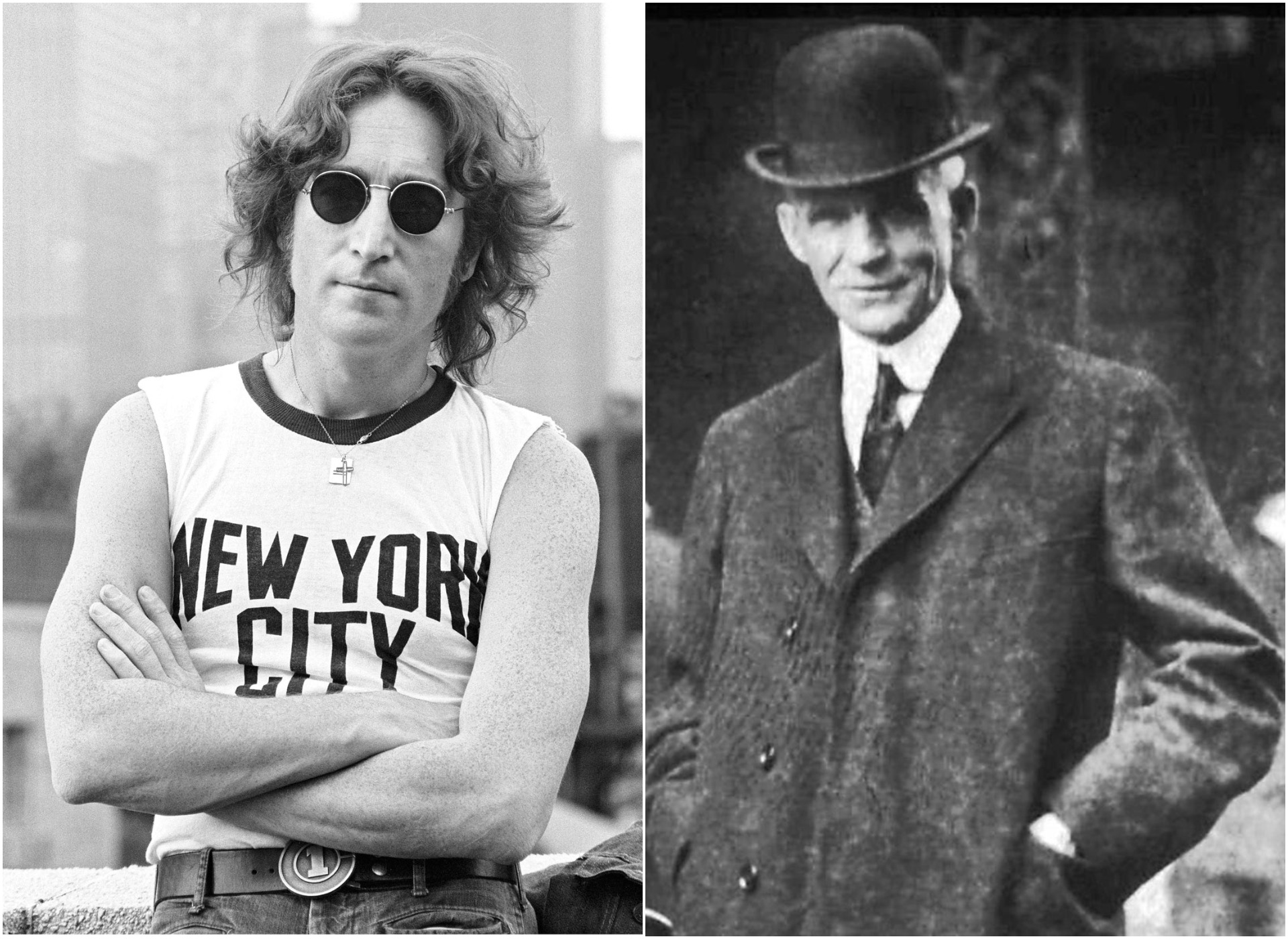

John Lennon once famously said ‘life is what happens to you while you’re busy making other plans’.

Recognising the truth in these words of wisdom, financial life planners know that the final plan really may not be final at all.

This is why they will regularly ‘check in’ with their client to ensure they are staying ‘on course’ to meet their goals and dreams as there will undoubtedly be changes in their lives and new obstacles will invariably crop up.

In the current climate there has never been a better time to create your life and financial plan, so once we are through this coronavirus crisis you will be in a great position to move forward in a life that inspires and rewards you.

Contact me by telephone or email for a free virtual ‘discovery’ meeting. Call me on +34 654 898 303/+44 77230 27864 or email me at [email protected]