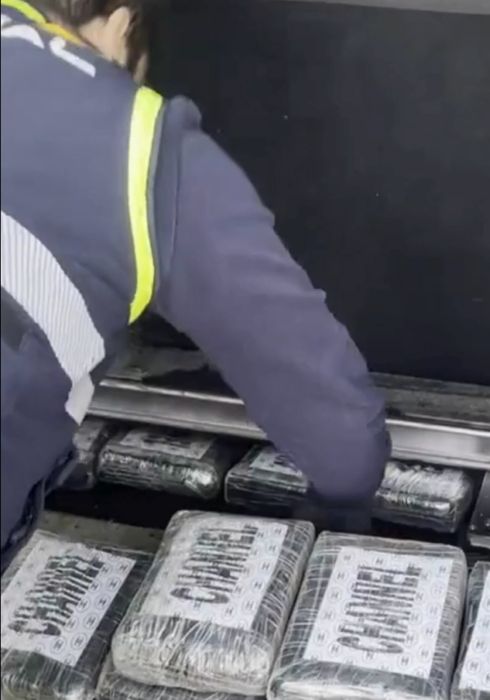

SPANISH tax authorities were defrauded of almost €69 million in IVA which was not paid on alcoholic drinks purchased by a network of firms and front men.

The Guardia Civil and Tax Agency have arrested eight people who bought 8.2 million litres of spirits between 2018 and 2024 and dodged tax payments.

The dismantled organisation had 93 companies in Spain, Germany, Portugal, Malta as well as the Turks and Caicos Islands which had low tax rates.

READ MORE:

- Juan Carlos of Spain dodges tax fraud rap as ghost of brother’s death still looms

Spanish court gives ex-Real Madrid coach Carlo Ancelotti one-year prison sentence for tax fraud - Good news for Shakira as prosecutor calls for second tax fraud case in Spain to be shelved

Authorities said money made by the swindle was laundered via the British dependency and the group used a variety of shell companies- most of which disappeared months after being formed and had an air of legality about them.

19 searches homes and business premises were searched in Barcelona, Cadiz, A Coruña, Madrid and Valencia, as well a room of a luxury hotel in Ibiza where one of the three alleged ringleaders was staying.

Several of the detainees had a history of similar searches.

The long list of seized items included a yacht, five high-end vehicles (including three Porsches), 34 luxury watches and €333,085 in cash.

Bank accounts with a balance of more than €700,000 have been blocked and an order has been issued to seize 21 properties.

Those arrested have been accused of crimes against the Public Treasury, money laundering, document forgery and membership of a criminal organisation.

Investigations started in 2023 after tax inspectors detected the possibility of a massive fraud being run via a tax warehouse for alcoholic drinks in Valencia province.

They then filed a complaint with the European Public Prosecutor’s Office.

The subsequent probe revealed that those who have been arrested acquired large quantities of alcohol from other EU countries and transferred it to the Valencia warehouse.

They also had similar facilities in the Netherlands and Portugal to use in an operation where they did not have to pay IVA by taking advantage of the existing transitional taxation regime for the tax in intra-community operations.

Bottles were sold to wholesalers without having paid IVA and all the profits were laundered via shell companies and a series of bogus invoices.

Money was switched between multiple bank accounts making it very difficult to trace.

Click here to read more Crime & Law News from The Olive Press.