FALLING markets, an EU referendum and two – soon to be three – Spanish general elections, everything that could have gone against the property market in 2016 has done.

And yet Marbella is standing strong, as it always does.

Pia Arrieta, Partner of Diana Morales Properties, explains that despite the political and economic uncertainty Marbella continues to stand on its own two feet.

“Marbella is a market one unto its own,” she says. “We have gone through ups and downs before and compared to other coastal resorts Marbella has always fared well. This year is no different.”

She adds: “The Brexit vote wobbled the market, there is no escaping that. The lack of a government in Spain also added to buyer’s uncertainty.

“But things look to be on the up now. Even with the political uncertainty lingering, buyers are coming back.”

And Pia expects 2017 to be a good year for the market, in particular for areas on the outskirts of Marbella.

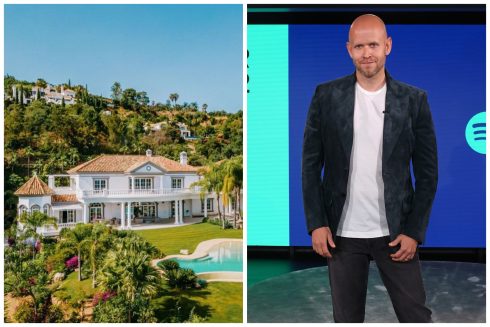

“Seafront properties in Marbella are always going to be popular,” Pia says. “What we have started seeing this year, and expect to see more of in 2017, is a boom in properties on the outskirts of Marbella.

“The new Golden Mile in Estepona is getting more and more popular as is Benahavis and areas east of Marbella up to Cabopino.”

• For more information visit www.dmproperties.com or call 952 765 138

Sales and price trends

After reaching a low point in 2011, property sales in Marbella began to rise consistently, recording year-on-year gains that have long since surpassed double digits.

In the beginning it was mostly driven by the very top end of the market (often in the form of luxury properties in the Golden Mile, La Zagaleta, Sierra Blanca and Camoján) on the one hand and heavily discounted ‘distressed’ properties located outside the Marbella area on the other.

As the unsold housing stock produced by the financial crisis was gradually absorbed – and here we have to stress that Marbella was only moderately affected by so-called toxic assets – the focus shifted to new-build homes, with the first new projects launched in 2012 and growing in number ever since.

Though this has in many ways been a ‘top-down’ recovery, it gradually broadened its scope from a premium segment heavily dependent on Russian buyers to one dominated by mid to high level homes attracting cash buyers from countries such as Holland, Belgium, France, the UK, the Middle East and above all Scandinavia, where Norway led the way.

Driven originally by discounted prices, they are now above all enticed by the lifestyle and prestige of this region, and while still keen on value for money are now willing to pay for quality and location. The result has been a gradual increase in property prices (Knight Frank’s PIRI report cites a 2% increase in property prices in Marbella during 2015).

The bigger picture

In terms of investment and development, the move is towards bigger, with the bespoke smaller projects gradually overshadowed by larger-scale projects that can now count on participation from major banks. This is in itself a sign of growth, and it comes amid a climate of economic recovery on a national level too, with Spain posting 3% GDP growth in 2015 (the highest in Europe) and a steady drop in unemployment. Public finances are looking a lot healthier than a few years ago, as are the nation’s banks, though it is in spite of the political impasse that marked the first half of 2016. Political uncertainty surrounding the elections of December 2015 slowed the flow of foreign investment into Spain towards the end of the year, yet the good news is that the Spanish property and construction sectors are once again contributing to economic growth as bank mortgages have returned and domestic sales are gradually rising.

Buyer profile

The top segment of Russian buyers who dominated the market at the height of the recession have been greatly reduced in numbers.

This is not essentially something to do with Marbella but largely the product of geopolitical factors that are also encouraging middle class, affluent buyers from the Middle East.

The market is now dominated by properties between €1 million and €5 million, with the rush of Norwegian high-end buyers that led the years of recovery now abating.

In their wake has come French and Belgian buyers driven as much by dissatisfaction with high taxes and domestic insecurity as with the charms of Southern Spain. For much of 2015 it was the British who led the way with rekindled gusto.

However, interest has cooled in 2016, as many British buyers wait to see what the fallout of voting to leave the EU brings. Countering this, there has been a growth in Middle Eastern buyers, while traditional markets such as the Netherlands retain strong momentum, while interest from China and Latin America has been slower to take off than was at first anticipated. This said, together with a slowly resurgent domestic market the demand for Marbella real estate is both stronger and broadly diversified.

The housing market

The majority of homebuyers on the Costa del Sol right now are looking for modern/contemporary homes. In the main, these can be defined as apartments and villas that feature sleek white-washed architecture, floor-to-ceiling windows, open-plan living areas incorporating modern style kitchens and the latest styles in bathrooms and terrace areas.

In villas there has been a move towards somewhat more compact and easily maintained properties, with wine cellars moving out of the basement to become backlit glass design features often situated between the kitchen and dining room.

Home cinemas and games rooms are being integrated into one interactive entertainment area typically complete with bar, with areas such as gyms and home spas, increasingly sophisticated in their aesthetic presentation.

Modern technology plays an important role in these homes, with home automation systems, modern lighting settings and online connectivity gradually becoming a must, along with the security offered by gated villa communities.

Given such a prevailing wish list, it is not surprising that newly built apartments and villas are leading the way in terms of desirability, prices commanded and speed of sale, with off-plan buying very much back in vogue – as is evidenced by the off-plan selling of projects such as Los Olivos, Les Rivages and La Finca de Marbella.