IT’S been a slow train coming, but after seven years of ‘la crisis’ there are finally some signs of light at the end of the tunnel for the Spanish property market… at least in the best areas of the main cities and prime parts of the coast where foreign buyers tend to buy.

Elsewhere the housing market is largely moribund, creating a two-tier market that could last for years to come.

After false dawns at the start of 2011 and 2013, when sales appeared to increase in what turned out to be a mirage of inflated sales created by a government tinkering with the tax code, the property market expanded by 10% in January, according to monthly data from the National Institute of Statistics (INE).

That is the first time the market has genuinely expanded in January since the crisis began.

Even more encouragingly, the Spanish housing market has grown on an annualised basis for five consecutive months, and in ten out of the last eleven months, suggesting that the market has finally found a floor after seven years of declines.

There were 286,408 home sales last year (excluding social housing), up 4% compared to 2013, though still down 60% compared to the peak year of 2007.

And looking just at January – the latest figures from the National Institute of Statistics – the market increased by 10% in a year, and 28% in a month, which is all positive news for Spain.

But look more closely and it’s clear sales are concentrated in various areas and in segments, so the good news is not evenly spread.

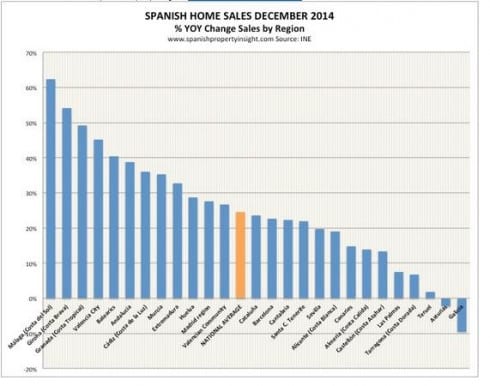

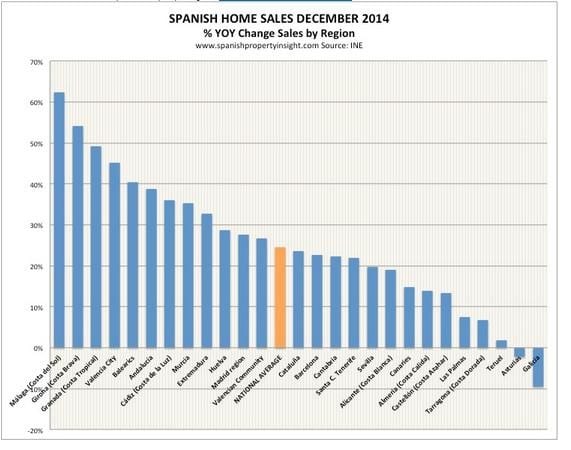

Malaga province, home to the Costa del Sol, was the star performer in 2014, with sales up 20% in the year, compared to a national average of 4%.

Based on this data it looks like the Costa del Sol housing market is clearly recovering.

Other markets with big increases last year were the Balearics, the Costa de la Luz, Madrid, Barcelona, and the Canaries – all areas that appeal to foreign investors.

In contrast, areas that rely heavily on local demand, like Sevilla, and Aragon, were still shrinking by 10% or more last year.

So, a gulf is opening up between segments that attract foreign buyers, mainly on the coast, and those that rely on domestic demand, mainly in the interior.

Another big difference emerging is that between new build and resale segments. The pipeline of attractive new developments is running dry all over Spain, which explains why new home sales plunged almost 20% last year, while resales increased by 20%.

In Malaga province, new home sales fell 10%, while resales rose 50%.

The market would almost certainly be more buoyant, especially on the Costa del Sol, if there were more attractive new projects for sale. The biggest constraint is now financing for new projects, and it will take time to bring new developments to market.

With increasing sales in places like Marbella, house prices are responding with small gains in the best areas.

Data from Idealista.com, a property portal, shows that asking prices have risen 9% in Marbella since bottoming out in the second quarter of 2013, taking them to 83% of their peak prices – a peak-to-present fall of 17%, and shrinking.

We can thank foreign investors for the recovery in places like Marbella and the Costa Del Sol. Domestic demand is still hamstrung by high unemployment and mortgage restrictions, but foreign demand is diversified and better financed, and taking full advantage of today’s prices to snap up bargains.

Foreign demand increased 14.5% last year, to reach a record 14% of market share, lead by the British up 28%.

It seems the British love affair with Spanish property is still strong if the price is right.

Mark Stucklin runs www.spanishpropertyinsight.com, a property information website.

Mark, I am not a person to write a long deliberating response..

No one reads such posts so I shall try and be clear and concise;

A property is worth what a buyer is prepared to pay for it; any property will sell on the coast or inland to a non- Spanish Citizen/ Spanish Resident if they have the currency value on their side. I trust you watch the markets. Dollar hurtling towards parity..Effects Sterling of course!

Location is key; I scrutinize the Spanish and English property websites daily; Many typical Spanish owners of fincas, apartments and the good old townhouses are in denial – some owners of fincas will actively try and sell a 70 square metre finca home located on a massive plot for way over the market value (whatever that is). No water, electricity, we recently went to see one and the Spanish owner realised we were English and tried to tell us it was OK to tap into the mains???? No, that is not right.

Communities can be a nightmare.. high community charges and no neighbours.. often when buying cheap apartments it is likely that the community is not fully occupied and owners are not paying their fees.. This means that your pool and gardens will not be maintained. Also, and I´m absolutely sure I´ll receive some support here.. many owners have been left high and dry paying deposits for properties that were not or were ever finished, losing them thousand but I am encouraged by recent EU rulings that ensure they receive their money back etc. Maria has, it seems been great in administering this.

My view may seem negative, but, it is real. I also fear I have broken my pledge and written a rather “long-winded” account – never my intention, however I wish to explain the real issues. I hope you understand and realise that readers need facts.. not Real Estate façade..

Regards

A B

I t can not legally. The helicopters have been flying this week – I hope you are informing your client of this.

Also, many expats truly believe that things are getting better because of a myriad of data.. Be careful – an increase in house sales doesn´t equal an equal in house value.

The focus of your article could be There are purely more sales.. You should be warning potential buyers regarding the extras taxs they will have to pay if they have genuinely purchases a one price but the Junta value the property higher thus taxes are

Marbella property has a long way to go before the word recovery is used. Just more stuff pulled out of the air by someone who runs a property sales website.

Finally a comment rooted in reality, and not “Stucklin Spin”.

Thanks Mark for a well-informed article based on fact, that will be of use to anyone considering investing in Spain (I still feel renting is the better option for now). No doubt those who dislike the growing recovery (maybe HomeAway operators who don’t want competition?) will try and rubbish your research, but when they can only come out with personal abuse and cannot provide their own facts and figures, well the intelligent analyst will know who to believe.

One does not need to be an “intelligent analyst”, one just needs to read nearly a decades worth of property nightmare stories from the online media to see the facts. Simples.

Stucklin states that financial constraints prevent any more attractive developments being started on the CDS Has he ever been there. It’s full up, last thing. The place needs is more developments good, bad or ugly.

I think we have been here before with his predictions that property sales are doing well Grin!