Words by Jonathan Holdaway

SO if you’ve kept your nerve and resisted the urge to pull your money from the markets and retreat to the relative safety of cash, you could now be looking at a reduction in the value of your portfolio of around 25% depending on where you were invested.

The recent brief recovery at the start of last week may have raised your hopes a little, only for markets to slip back again a few days later, after worse than expected US unemployment figures were released.

In the words of Private Jones from Dad’s Army ‘Don’t panic!’

The last major downturn in stock markets was in the ‘credit crunch’ or financial crisis which started to have an impact at the end of 2007 – following another ‘black swan’ event created by the investment banks.

In that crisis it took the FTSE 100 some six years to return to it’s ‘pre-crash’ level – however had you invested wisely near the bottom of the market only 18 months after it started to drop, you would have been looking at a very good return on your investment when others merely returned to par.

My first experience of a stock market crash was ‘Black Monday’ back in 1987, when I was working for an asset management company, promoting our products to IFA’s to recommend to their clients.

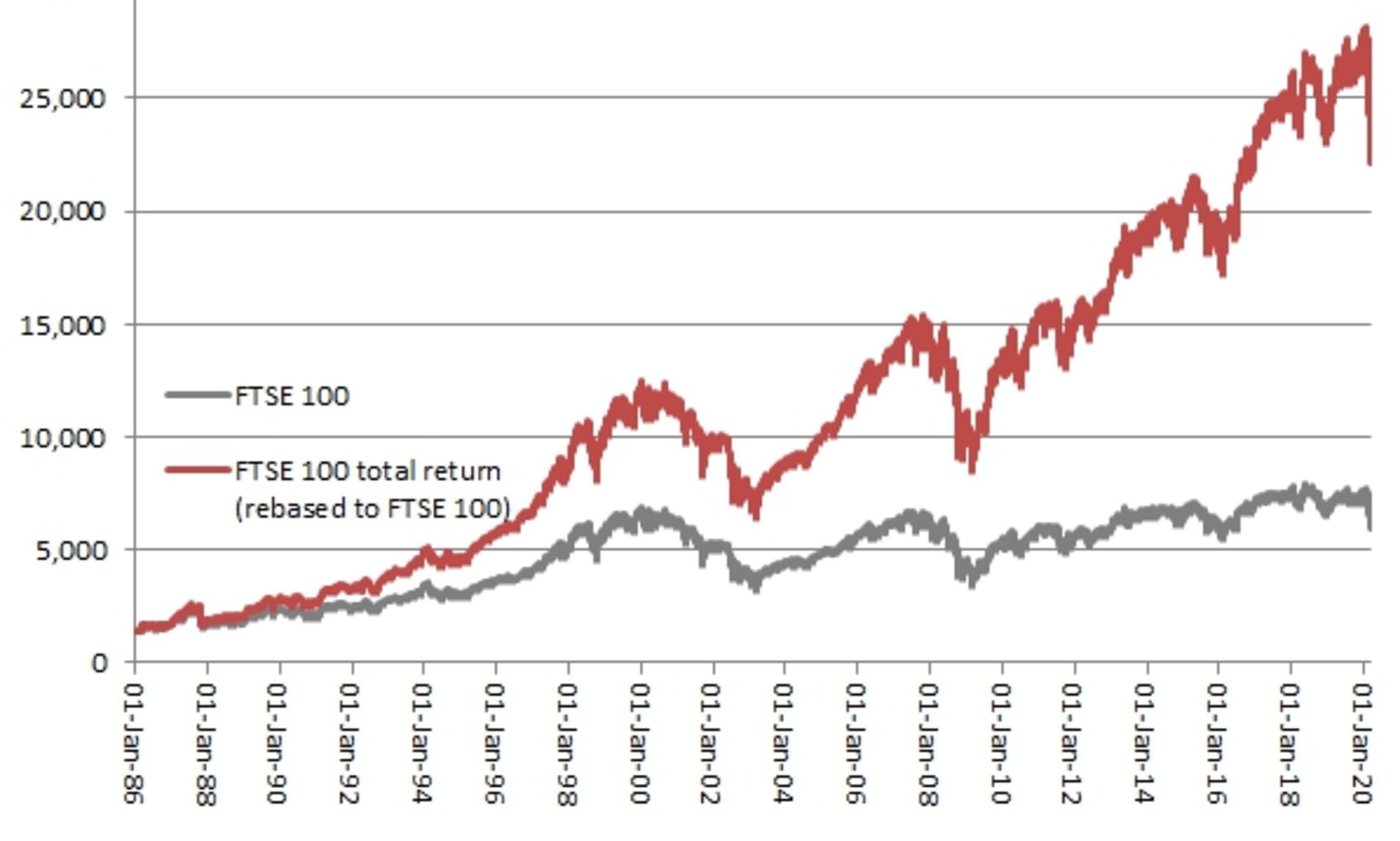

At that time we all thought it was the end of the world, but now looking back at a graph of the FTSE 100 it’s just a small blip on an otherwise relentless upwards march.

Sure, there have been a few other somewhat bigger ‘blips’ between then and now, but again these are put very much in perspective when we look at the longer term trend.

No one really knows how long the current situation will last, or its lasting effects on the global economy.

Early signs from China seem to suggest that they have the virus under control, and have started to return tentatively to a normal existence.

However long it takes, I can virtually guarantee that stock markets will recover and people will make money again.

To help you through here are a few habits you should try to develop when markets are volatile:

1. Tune out the noise – nowadays news and information is so readily available any time on our mobiles. Never check the value of your portfolio when markets are tanking – hasty decisions lead to costly mistakes.

2. Control what you can – a good example of this is costs. I am doing a lot of work with new clients who have expensive and poorly performing funds in existing portfolios. By replacing some or all of these with ultra low cost ETF’s – often index trackers which work better in ‘developed’ economies, I am able to put them in a better position for when the markets do bounce back.

3. Revisit your asset allocation – if market volatility is causing you to lose sleep then it may be time to re-evaluate your risk tolerance. If you are feeling particularly ‘bullish’, in the near future the perfect opportunity to invest some spare cash back into equities could pay off big in the longer term.

4. Set realistic expectations – again you are investing for the long term. I don’t apologise for continually repeating this, as there will sometimes be bad years but in the long run your equity returns will average out to be better than cash and many other asset classes.

5. Stay diversified – a great way to insulate your portfolio is to have exposure to other asset classes such as fixed interest, property, precious metals and for equities, global stock markets rather than just solely the domestic market.

There are no cast iron guarantees to investing, but by developing these habits, you can make volatile stock markets work better for you in the long run.

In the near future we will be running some financial workshops along the Costa del Sol, along with other professionals – accountants, lawyers and estate agents to help you achieve the maximum potential with your money. Keep an eye out for confirmed dates and speakers in the near future.

Click here to read more Business & Finance News from The Olive Press.