MORTGAGE approval numbers are soaring.

Figures show that the number of loans approved year-in-year last November rose by 24.1%, making it the strongest month since 2010.

Some 36,220 home loans were agreed as the property market not only bounced back after pandemic restrictions, but actually started to boom.

This is a trend that we at the Finance Bureau have noticed continuing in the months since.

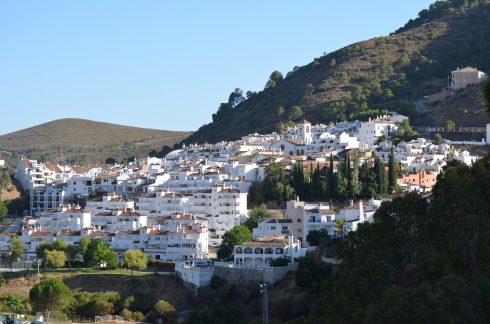

Anecdotally, many of our colleagues in real estate have been reporting some astounding figures. One agency in Marbella has already sold over €9 million worth of property since the start of the year, while others have told us about their best start to the year in terms of sales they have ever experienced.

But with sales booming, it’s important to remember how crucial mortgage brokers can be.

With established links to all the major Spanish lenders the Finance Bureau acts as a go-between for the client and the bank – but it is important to remember that the broker is not connected to the bank – and works to find the buyer the best deal available.

It is essential to have someone in your corner to highlight any hidden fees or compulsory add-ons tucked away in the small print and to ensure you get the best possible mortgage rate to suit your needs and circumstances.

One of the biggest pitfalls can be ‘trap-related products’ that often get hidden in the small print. These additional products get attached to your mortgage and usually include insurance policies.

It is important to know exactly what is attached to your mortgage. What may seem like a great rate can be soured by expensive – and sometimes unnecessary – insurance packages.

Using a broker will save both time and money as they will be looking out for these hidden add-ons and will always look for ways to lessen their impact.

And while the vast majority of banks specify the fees and commissions they charge, not all of these costs are always declared.

But the best way to ensure a good mortgage that does not hide anything in the fine print is to solicit the help of a mortgage broker.

When it comes to picking a mortgage, you must get it right on the first try as due to the relatively high transaction costs, it is virtually impossible to reverse.