IT’S no wonder people get totally confused between a legitimate pension transfer and a pension liberation scam, when there appear to be conflicting messages coming from official channels.

On the one hand, for some years HMRC has been fighting against pension transfer schemes that enable greater access to pension fund savings than traditional UK pension legislation will allow – the so-called ‘pension liberation schemes’. Such schemes have often gone hand-in-hand with questionable investments, many of which have gone badly wrong, leaving the individuals concerned severely out of pocket, if not in financial ruin! It would be nice to think that HMRC’s efforts were aimed at protecting individuals from such predatory activity. The more likely truth is that they’re trying to protect their tax take when pension benefits are taken under the UK rules.

On the other hand, we had the announcement in this year’s March Budget, endorsed by the Chancellor at the Conservative party conference, that full pension fund access for over 55s will be available with effect from April 2015. You might ask, what is ‘full access’, if not pension fund liberation by another name?

The difference is the fact that HMRC will also be a beneficiary from any UK taxpayers availing themselves of the new rules. Although 25% of funds taken will typically be tax-free, any excess will be taxed as income in the relevant tax year, with the highest marginal rates of income tax applying.

So now it will be legitimate to have full access to the fund and there has already been much written about the potential for people to recklessly cash in their pension to buy a Lamborghini (although, as far as I’m aware, Lamborghini has no plans to increase production)!

With sound financial advice, from professionals who are qualified to take into account all the relevant considerations, this greater flexibility offers more financial options and the ability to plan levels of income tax payable in a controlled way. In some ways it will be like having the full à la carte menu as opposed to the menu del dia. But as we know, more choice means more deliberation

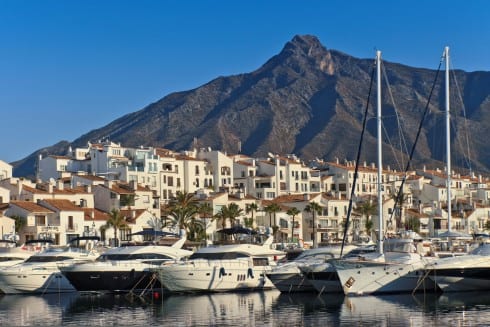

In the UK, I would like to think that the regulatory regime will protect people from the unscrupulous. Sadly, I fear that there is also the potential for a free-for-all in less well-regulated countries which allow unlicensed advisers and unregulated, high commission-paying contracts to be sold to an unwitting public. This includes Spain where, in my opinion, there are far too many commission-driven, so-called ‘advisors’ who are rubbing their hands in anticipation of a Klondike scenario next year.

Freedom of choice over how to use your pension is good news, in safe hands. But beware: the predators are lurking and, in some cases, they’re already pouncing!

Pension liberation is rampant, I tried getting pension info and the next moment I am called by a firm wanting to take my pension?

http://johncase.simplesite.com/413056335