EASTERN European phone scammers have been preying on fellow expats across Spain, an Olive Press investigation has revealed – siphoning at least €45,000 from just three victims in less than a year.

Posing as Spanish police officers and Bank of Spain officials, the fraudsters targeted multiple Bulgarian and Russian nationals living in different parts of the country, demanding urgent transfers of several thousand euros to foreign bank accounts.

Victims were subjected to intense psychological pressure, including threats of prosecution and even emotional manipulation.

In one case, a scammer sent a victim a chilling message: “How are you going to look your children in the eye if you lose all your money?”

The gang used the same ruse in at least three cases – two in Cantabria last December, in which a Russian and a Bulgarian national lost a total of €38,000, and one in Valencia last week, when the group drained €9,900 from a Bulgarian mother of two.

The Valencia victim, 49-year-old Elena (not her real name), told the Olive Press about her ordeal.

“They put such a fright in me that I eventually agreed to do as they asked,” she said.

On Tuesday last week, Elena received a call from a woman who spoke to her in Bulgarian – though with a hint of an accent she identified as Russian or Ukrainian.

Masquerading as a chief detective with the Spanish police, the caller claimed that a relative of Elena’s was under Interpol investigation and had illegally obtained power of attorney over her Spanish bank account.

The bogus officer then warned Elena to move her funds elsewhere to avoid being dragged into the supposed probe, adding that a Bank of Spain clerk would soon contact her with instructions on where to transfer the money.

“They told me that if I did not collaborate I might end up in jail,” Elena said.

A call from the alleged bank official soon followed, ratcheting up the pressure on her to wire the funds to a Swiss bank account.

Elena requested multiple times that they speak in Spanish, but the fraudsters insisted that because Interpol was involved, all communication had to be conducted in Bulgarian.

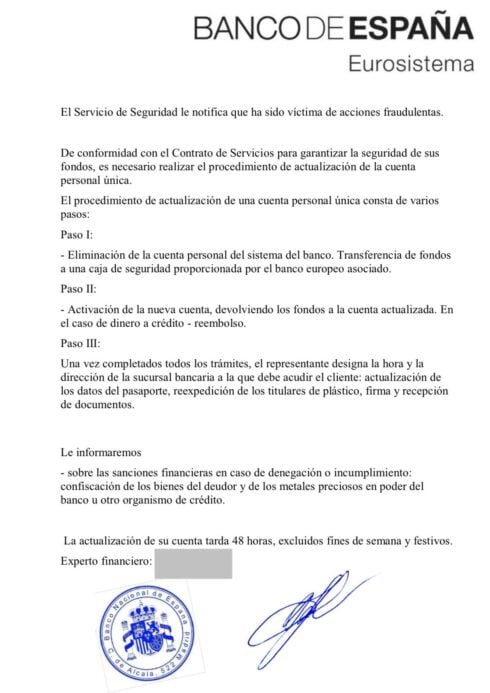

The scammers also sent the victim a photo of a Spanish police ID and a document bearing a Bank of Spain watermark – both believed to be forged.

“It was terrifying,” Elena said. “They basically kept threatening me until I gave up.”

After parting with the money and realising she had fallen victim to a scam, Elena reported the case to Valencia police, who said they had launched a probe into the matter.

She also repeatedly contacted Swissquote, the recipient bank in Switzerland, in the hope it might agree to return the money.

Swissquote officials replied they were investigating the case – though Elena was never put through to the bank’s fraud specialists and could only speak to customer service.

Elena also sought support from her own Spanish bank, La Caixa – but added officials did very little to help, explaining all they could do was wait and hope for a refund from Swissquote.

“They did absolutely nothing to protect their client,” Elena said.

The day after the fraudsters first made contact, they reached out to Elena again – this time via text – demanding she send more money.

Elena refused, insisting the bogus officials meet her in Valencia.

The scammers then repeated emotional threats similar to those sent earlier, warning that she could face jail time and attempting to guilt her over her children.

They said: “What if you cannot prove you are innocent? What are you going to do then? Make money while in jail? Are you going to pay off your debt from there?”

This time, the fake officer agreed to Elena’s request to communicate in Spanish – but the texts appeared to have been run through an AI translator.

The bogus Bank of Spain clerk, also prompted by Elena to switch to Spanish, never responded to her request and deleted their conversation instead.

Elena confirmed that neither caller ever spoke to her in Spanish over the phone.

Reports of similar scams have also emerged in other European nations, suggesting the fraudsters – who appeared unwilling to speak Spanish – may be based outside of Spain.

In a case that bore striking similarities to those reported in Spain, a Latvian woman was conned out of more than €160,000.

Fraudsters convinced her that criminal activity was going on in her accounts, got her to install remote-access software, and made her transfer large sums – even instructing her to send cash via parcel machines.

In another case, a Latvian man lost about €12,000 after being pressured to withdraw his savings and hand them over to supposed law-enforcement operatives.

Lithuania has also seen a spike in so-called vishing (voice phishing) calls. According to the Lithuanian Police and financial-sector sources, scammers speak in Russian, claim to be from the police, and allege suspicious transactions on people’s accounts.

In some of these cases, the fraudsters try to get victims to hand over online-banking credentials or use remote tools, putting their money at risk.

Click here to read more Crime & Law News from The Olive Press.