I DON’T understand the so-called professional financial pundits who say you can never better the market, so don’t try.

Recently I read a report from one of our major banks which made my blood boil. ‘If you are investing in equities, which historically produce higher returns, your money needs to be invested for a minimum of five years to ride out short–term fluctuations,’ it said. ‘This timescale is a minimum: ideally, you should be looking at an investment period of 10 to 15 years. That way, any big falls are likely to be balanced out by the gains. Perhaps those gains will be greater than the falls.’

And if the gains are not greater than the falls, then you lose … but, of course the bank, with its charges, wins whichever way the cookie crumbles.

As an investor, it is important to become familiar with the arena in which you are operating. There have been more than 100 market corrections in the last 110 years – that is, around one per year, and more than 30 ‘bear markets’ during that time. The corrections average about a year from top to bottom and back, whereas a bear market may fall by 25% or more and last a year and a half before reaching the bottom and turning.

It is not surprising that Fund Managers will advocate that you should stick with their funds through the thick and thin of stock market fluctuations. Naturally, they do not want to see the volume of money in their funds falling, as it will affect their remuneration.

In times of market volatility, different sectors are affected differently. The manager of a fund in a failing sector is not allowed to diversify away from his own sector and has to stay invested. Under these circumstances, the best manager in the world may lose you money.

You, however, as an independent and informed investor, can switch horses from a failing sector to a winning sector or, in extreme conditions, go into cash.

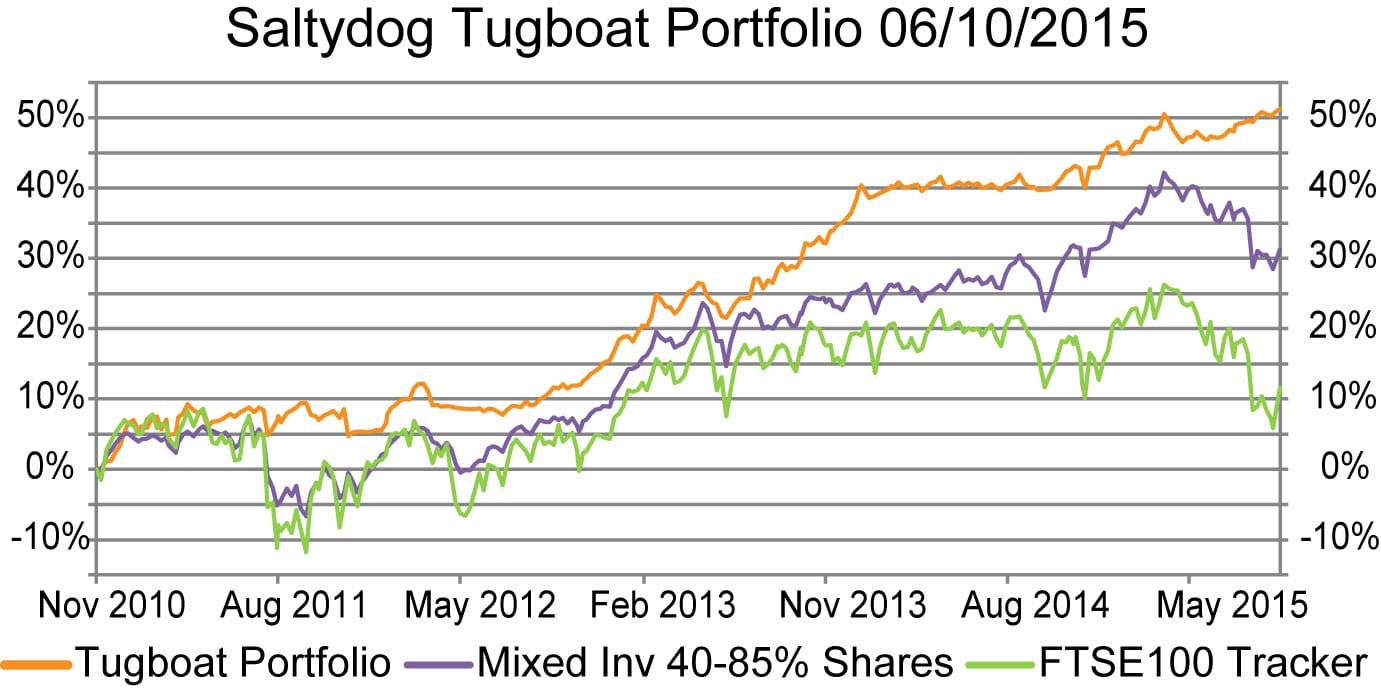

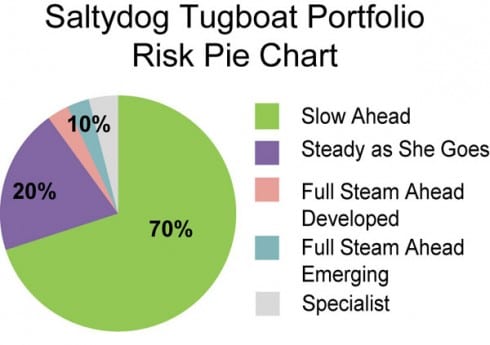

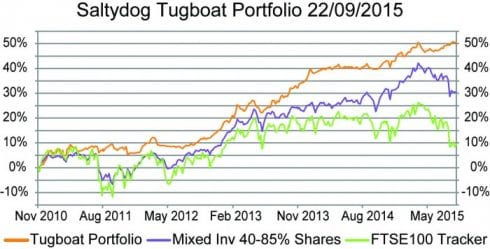

The Saltydog Investor gives you all the information to make these decisions and even runs a demonstration portfolio that shows its ability to avoid the market falls and corrections.

• To find out more, or better still to take the two-month free trial, please go to their website www.saltydoginvestor.com

Click here to read more News from The Olive Press.