HELPING people with financial planning is my job. When I’m asked for ‘shortcuts’, ways to bypass the effort but still reap the benefits of financial planning – I respond subtly, by pointing out how this might end up undermining results:

-“It sounds like you want to skip main courses and jump to dessert,” I tell them.

-“Exactly!” they respond.

Subtlety, apparently, isn’t always an effective way of communicating.

Still, I’m aware of why I’m asked this question. It’s a way of saying, “I want a ‘sampling’ of the advantages of hiring a financial planner to evaluate whether to hire one.” Said another way: “I want to know if it’s cake or just frosting before I take a bite.”

Okay, I get it, I’ll share two simplified money management ideas with you today. There is a wide array of methods to look at financial planning data. This list includes the metrics approach, ratio analysis, the life cycle approach, and many more. Using a single method may not be enough to develop a comprehensive financial plan. On the other hand, employing too many approaches simultaneously can create redundancy or confusion. Let’s have a look at the pie chart approach. It provides a visual representation and a broad perspective of how we allocate our financial resources-

Pie chart approach

The pie chart above visually displays our “income statement”. It divides up how we use our income as if it were a pie. We can only spend 100 percent of what we earn and seeing where we spend our “dough” (sorry, it’s a pie pun I couldn’t resist) is sometimes an eye-opening exercise.

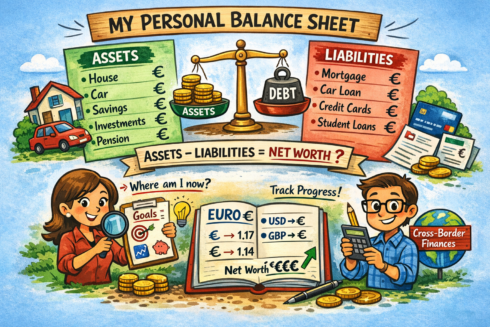

The twin “balance sheet” pie charts answer the questions of what we own (chart following) and the pie chart underneath it shows whether we owe a debt (liabilities) – if not, it’s part of our net worth. These two pies are the same size: the chart on the top depicts our assets whereas the chart underneath it cuts this same pie into slices of what we owe (liabilities) and a slice for what is ours without debt (net worth).

Some finance experts would tell us these pie charts oversimplify complex financial realities. Nonetheless, they are helpful for visual learners and can be compared to benchmark pie charts to target where we should be to meet typical goals and objectives.

Another example of the merits of financial planning I’d like to share with you is not a method or approach, it’s more of a “mirror question” because it reflects back at us and invites self-examination-

Time machine – what you’d tell your younger self

If you could climb into a time machine and have a chat with your 18-year-old self about money, what would you say?

In my case, I would give my ‘past self’ three tidbits of financial advice:

- Start earlier than feels comfortable. Small amounts invested early grow more than big sums invested late.

- Buy ‘experiences’, not stuff. In hindsight, lots of the goods I thought I needed when I was younger are now landfill. On the other hand, expenditures on education, travel, and health continue to pay “dividends”.

- Avoid debt unless it’s inescapable. Loans and credit cards seem like easy solutions, but interest robs from my future self. Only borrow when necessary (mortgage, student loans) and be disciplined when doing so.

While none of us get to step into a time machine, the good news is that our ‘future self’ still exists — and he/she is pleading with us to plan wisely. Every smart choice we make today is sending them a gift through time.

Hopefully, these two samplings illustrate how hiring a financial planner might increase our clarity, decision-making and ‘peace of mind’ about money. Both should come with a warning label, too: 1) try not to eat the savings slice in the pie chart and 2) don’t be surprised if, when you have a chat with your younger self, you second-guess your past haircut choices.

Peter Dougherty is a Financial Planner at BISSAN Wealth Management in Spain. He holds an MBA in finance from Columbia University in New York and an MS in Spanish taxation (Máster en Fiscalidad y Tributación) from Nebrija University in Spain. He is certified as a European Financial Planner (EFP) in Spain and as a Chartered Retirement Planning Counselor® and Investment Adviser Representative in the United States.

For more information: https://www.financial-planning-in-spain.com

Click here to read more Business & Finance News from The Olive Press.