Weekly Market News

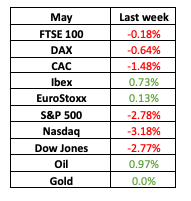

Share markets had another choppy week, with worries that rate hikes, cost pressures and supply chain disruptions would further weigh on the Consumer – particularly in the US where we saw some profit downgrades from two of the big retailers. This led to the US share market having its 7th consecutive weekly fall and dragging the global share market down with it too. UK inflation also grabbed the headlines (highest print in 40 years) but was actually a touch less than expected, and Asian share markets bounced on the back of stimulus from the Chinese authorities. There are some fairly big names reporting earnings this week as well as some key survey data for markets to focus on as we look towards the end of the month.

Last Week

- Global stock markets fell about 3%, mainly driven by the US market

- US Consumer stocks were hardest hit, with some heavy falls from the household retailers

- Asian stock markets bounced and the UK market was fairly flat

- Bond markets generally struggled following Fed Chair Powell’s tough talk on inflation

- UK inflation came in at its highest rate since 1982

- The Chinese Authorities looked to boost the economy by cutting certain interest rates

Things to look out for this week

- There’s a fair amount of data to look out for this week. Tuesday sees the release of survey data (S&P Global Manufacturing and Services) for the UK, US and Eurozone. Wednesday sees the Gfk German consumer confidence number and also the release of the FOMC minutes from their last meeting. Friday then sees the release of US PCE inflation, which is important as this is the number that the Federal Reserve look most closely at.

- In terms of corporate activity, we have Zoom reporting earnings today, Topps Tiles and Best Buy tomorrow and then Marks & Spencer and NVIDIA on Wednesday. Thursday sees Costco, Gap and Dell reporting earnings.

For more information or if you would like to discuss your finances with one of our qualified advisers visit www.chorusfinancial.com or call 965 641 163.